Banking sector: consequences of the Russian invasion

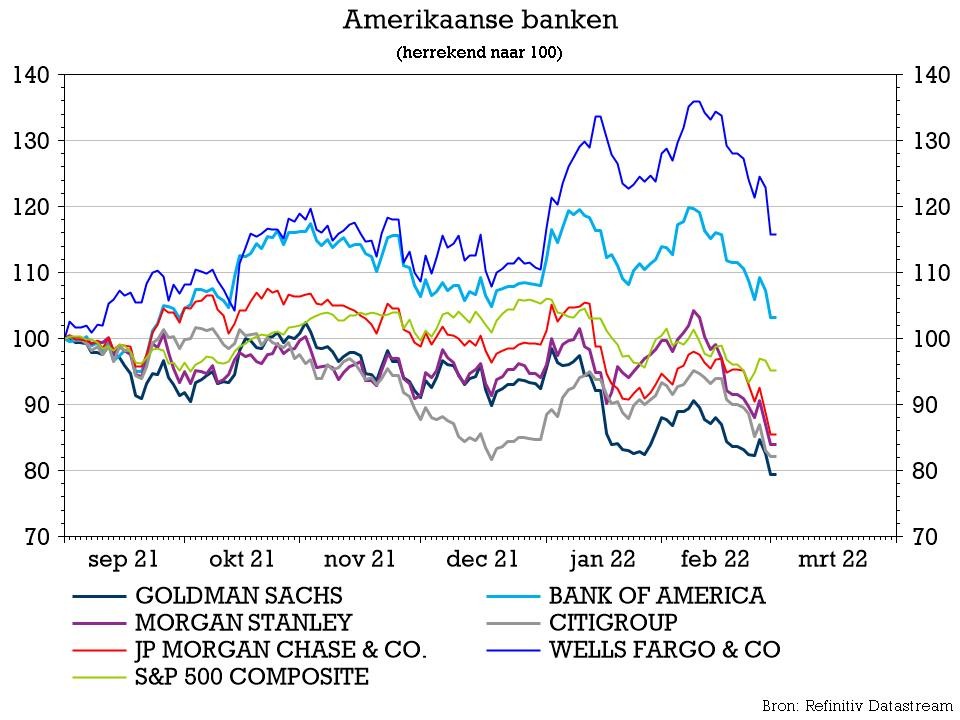

After a strong performance in 2021, the global banking sector got off to another strong start in the new year, helped by rising interest rates, an increase in valuation and a healthy fundamental position after the Covid crisis. The performance of the global banking sector rose to 10% in early February and actually posted a relative outperformance of 15% against the broader markets a week before Russia invaded Ukraine. Since this morning, global banks have seen all their annual profits evaporate, along with more than half of their relative outperformance versus the equity markets. European banks, which led the way at the beginning of the year, have lost no less than 20% since their peak in February.

Impact of sanctions on the Russian financial system

The Western sanctions against Russia will lead to a significant disruption of the Russian banking system and financial flows. The sanctions have impacted 80% of the assets of the Russian banking sector to a greater or lesser degree. In addition, some banks have been excluded from SWIFT. This will have an impact on cross-border payments, since around 85% of Russian exports and more than 70% of imports are settled in foreign currency. Russian banks can use an alternative system, but this is very small and mainly for domestic use. The exclusion from SWIFT could also lead to payment defaults.

The currency volatility caused by the sanctions against Russia's central bank prompted it to raise its interest rates to 20% on Monday. As the Russian policy response to these sanctions is likely to include capital controls, all Russian banks will be severely affected. This has already led to reports of mass withdrawals from deposits held at Russian banks. Russian banks have total credit outstanding with foreign counterparties of USD 180 billion, which they are currently unable to access. A worst-case scenario will result in a recession in Russia and higher finance costs, slower lending growth and a deterioration of the asset quality of the Russian banking sector. However, the Russian central bank will take measures to limit the impact on the balance sheet and capital position of Russian banks and to stabilise the financial system.

Exposure to Russia for global banks

On average, direct exposure to the Russian economy and its markets is very low. The total exposure of foreign banks to Russia is about USD 90 billion, of which USD 30 billion is direct exposure to Russian banks. Italian, French and Austrian banks together are exposed to Russia to the tune of just over USD 42.5 billion. Some European banks are exposed through a Russian subsidiary. The Austrian Raiffeisen Bank is the most exposed: 9% of its total loans and some 39% of its net profit derives from its subsidiary. Société Générale, Unicredit and the Hungarian bank OTP are also relatively more exposed, with loans from their local subsidiaries accounting for about 2% of total lending and 6-7% of net profit. ING and Intesa Sanpaolo also have local subsidiaries, but the share of local lending in total lending is almost negligible. It is worth noting that Raiffeisen and OTP also have a local subsidiary in Ukraine, accounting for up to 4% of total lending, while BNP Paribas, Credit Agricole and Intesa Sanpaolo have lower exposure through their local subsidiary in Ukraine.

The exposure of US banks to Russia reported so far amounts to USD 14.7 billion; most banks have very limited direct exposure, with the exception Citigroup, which has reported an exposure of almost USD 10 billion. Indirect exposure (companies with exposure to Russia) is more difficult to calculate, but is also likely to be small, given the extent of cross-border trade as evidenced by international trade volumes. However, some export-oriented companies, especially in Europe, will be affected by the conflict, potentially leading to higher loan losses for banks. All in all, it seems unlikely that the potential problems for a handful of banks could disrupt the normal financial flows to such an extent that policymakers were unable to remedy the situation easily.

Global economic impact

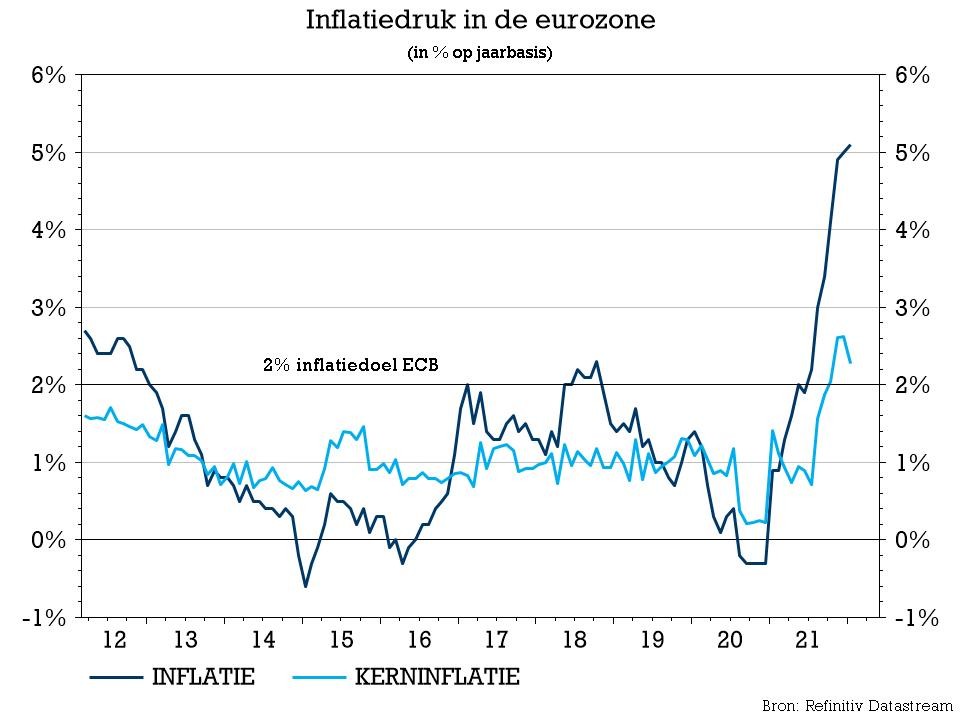

In addition to possible loan losses, bank investors also need to consider how the outlook for economic growth, inflation and interest rates has changed since the Russian invasion. Bank shares do well in strong economic conditions thanks to the resultant growth in lending, while the interest rate environment is of course also a key yardstick. Before the invasion, markets were counting on more than six interest rate hikes in the US by 2022 and two interest rate rises in the next 12 months in Europe. Such interest rate increases from the current historically low levels would have been very positive for the banking sector, boosting their net interest margins.

Although inflation is likely to rise further as a result of the Russian invasion, expectations of an interest rate hike by the ECB have already been reversed. The number of expected interest rate hikes In the US is also being reduced, although investors still expect the Fed to raise its rates for or five times this year. In addition, GDP growth may be negatively affected by uncertainty among consumers and businesses, as well as by higher energy prices and further supply chain disruptions caused by the conflict. However, fiscal support from governments could mitigate this effect. A further rise in inflation will impact on banks' operating expenses. Compared to a fortnight ago, therefore, the macroeconomic conditions for the banking sector have deteriorated dramatically, impacting their projected earnings growth. However, the real economic impact is more difficult to estimate and will only become clear over time.

KBC Asset Management's view on European banks

In the view of KBC Asset Management, no European bank is at risk of failure. Assuming a worst-case scenario for Raiffeisen Bank, in which all local assets were lost, the bank would still have a core capital ratio well above the minimum regulatory requirement. For the other banks, the negative impact would clearly be much smaller. The financing and credit risk for the sector looks to be limited at the moment, while the impact on profits is difficult to assess. The share price reactions for European banks are already appear to be more pronounced than they should be in theory.

However, economic uncertainty in Europe is fairly high given the proximity of Ukraine, while lower interest rates, fears of stagflation and potential credit problems are weighing on sentiment. The valuation of the European banking sector has returned to very low levels, even if we assume some profit cuts. Our analysts believe these stocks will eventually recover rapidly if the situation stabilises and interest rate forecasts are adjusted. However, judging the timing is difficult as the volatility and uncertainty may persist for some time. Consequently, the positioning of the EMU banks in the KBC AM strategy has been reduced to neutral relative to the reference market.

View on US banks

US banks are much less exposed to Russia. The overall impact on the US economy in the short term may be small, and GDP growth could benefit from the reopening following the omicron wave. Finally, a slower pace of interest rate increases in the US would not be as negative for banks' net interest income, as overly rapid hikes can increase customers' sensitivity to rising interest rates. Moreover, investors' fears of a Fed policy error would be lower. Prolonged uncertainty, lower bond yields and a de-risking environment are obviously also negative for the US banking sector, and the largest US banks with greater global exposure could be slightly more affected by the conflict. However, KBC AM still believes that earnings forecasts could rise if the Fed were to begin hiking rates in March at a moderate pace, as this has not yet been fully priced into the current outlook. Our analysts believe that US bank stocks could perform strongly even in a riskier environment, as long as the US economy holds up. Our long-standing preference for US banks within the sector therefore remains and the KBC AM strategy still takes a positive view on US banks, although the weighting was also reduced last week.

What does this mean for your investments?

We have reduced the equity positions from well above to slightly below the benchmark weight. Regionally, we have shifted our focus from the euro area to Asia and North America. In terms of sectors, we have mainly adjusted our positions in cyclical sectors and built up the holdings in more defensive sectors. We closely monitor markets and events and make adjustments when necessary.

Conclusion

The Russian financial system and economy will be severely impacted by the Western sanctions. However, the risks to the global banking sector are relatively limited, with only a handful of European banks being exposed to any great extent. A change in the economic outlook, an overweight position in the banking sector and risk-off sentiment led to the sell-off in the banking sector. BC Asset Management sees potential for bank shares, but uncertainty remains very high, especially for European banks. The risk/reward ratio for US banks looks much more attractive in the short term.

Still have questions after reading this article?

The information contained in this publication is for information purposes only and should not be considered as investment advice.