The Business Dashboard is the ideal all-in-one platform for your banking and insurance needs. As an administrator, there are many things you can register or change to tailor the Business Dashboard perfectly to the requirements of your company, ensuring it is always ready to move forward.

The KBC Business Dashboard: efficient, customised, flexible and highly secure

- A clear and comprehensive platform where you can manage your day-to-day business banking and access your company’s insurance products

- Customisable according to your preferences

- Freedom and flexibility to take care of your company’s banking and insurance needs whenever you want

- Secure access tailored to your company

Convenient administrator features

As an administrator, you have more powers. That gives you the freedom to respond more quickly to changes in your organisation and more effectively manage business banking and insurance matters.

As an administrator, you can easily make adjustments in your settings. Read on to find out more about the convenient features available to you.

- All administrators have the flexibility and freedom to quickly make changes to a number of administrative matters directly in the KBC Business Dashboard

- As an administrator, you can designate new administrators or remove existing ones

- We do our utmost not only to ensure that as many requests and activations as possible are carried out digitally, but also to limit the number of signatures needed for approval

One portal for all you administrator features

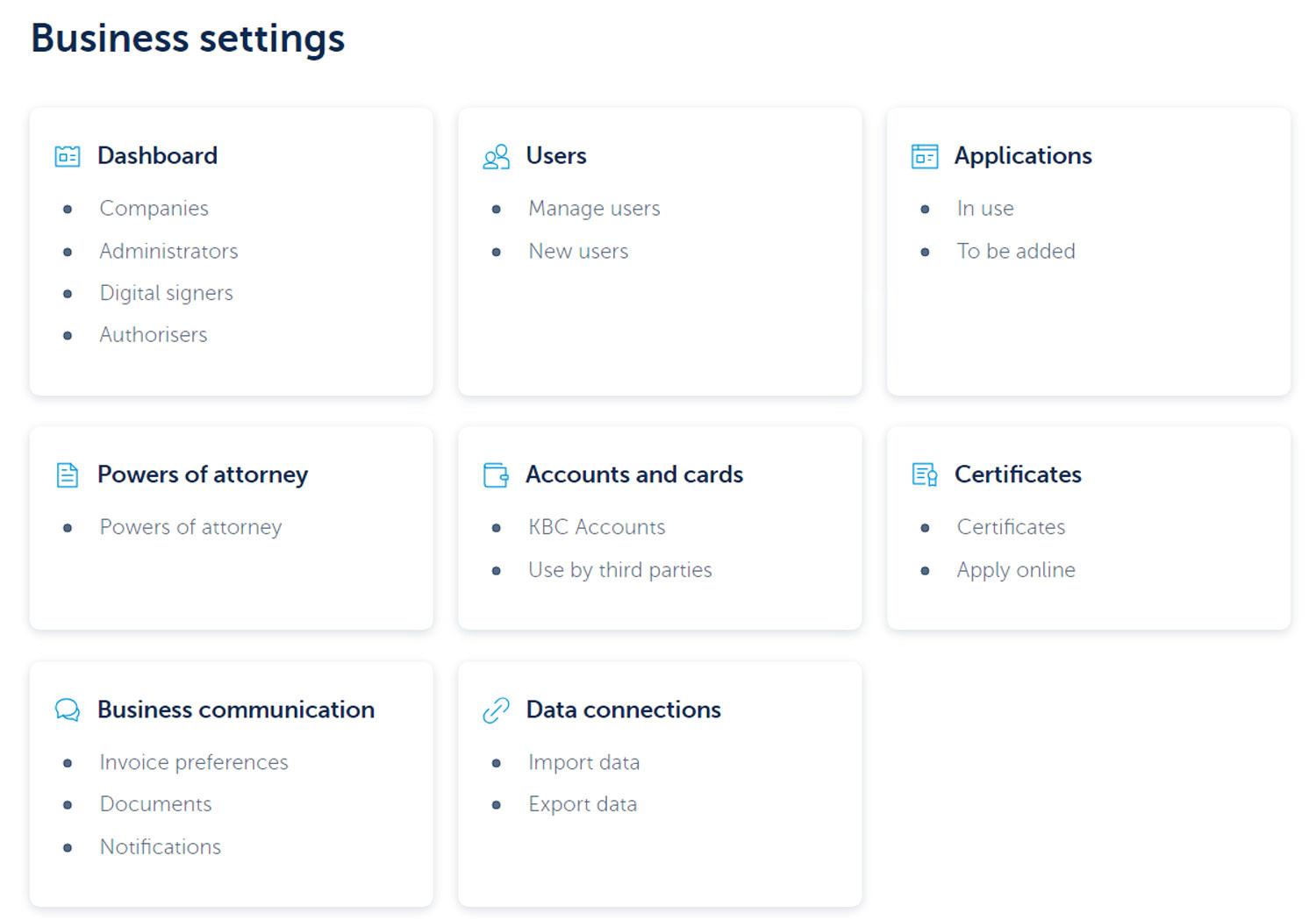

Administrator features can now be found in the settings:

Your administrator features

Managing users

Does your company already use the KBC Business Dashboard and one of the underlying apps, such as KBC-Online for Business, Go&Deal Pro, Working Capital Insights or ComFin Touch?

As an administrator, you can give a new colleague access to these apps in the settings.

- The employee is already known to KBC

Once you have submitted the request, the new user can start using the Business Dashboard.

- The employee is not yet known to KBC

You can also add this kind of user. They can then complete the request digitally by confirming a number of details. It's fast, easy and secure.

You can assign a customised security method to a new user. You can also assign a different security method to an existing user.

Yes, you can remove users.

Customising the Dashboard

If – in your capacity as an administrator – you add a user to KBC-Online for Business, you can now choose from seven separate modules. You can then easily customise the modules and underlying features for each user.

(Settings > Business settings > Users > Online for Business)

You can read more about the different modules and features below.

This module allows users to prepare payments, sign digitally and manage beneficiaries. Signing transactions always requires specific powers of attorney.

You can add or change these features for users:

- Credit transfers

Make payments easily and conveniently. Transfer money from your business account to your own or other accounts. You can set up both SEPA credit transfers and international transfers.

- Transfers from accounts abroad (TFB)

Transfer money from your accounts at KBC branches abroad (TFB) to your own or other accounts.

- TFB beneficiary management

Save recurring beneficiaries for the accounts you hold at KBC branches abroad (TFB). This allows you to automatically retrieve the details of these beneficiaries when making payments in future. You can also edit and delete the details of previously saved beneficiaries.

- Standing orders

Automate regular standing orders to suppliers so you don't have to think about it and your payments are always made on time. You can also manage existing standing orders.

- Pay by direct debit

Authorise suppliers to collect current invoices directly through KBC. The amount will be debited from your business account automatically.

- Upload payment files

Upload batched payment orders created with your accounting package and sign to have them processed by the bank.

- Upload direct debit/LCR files

Upload batched direct debit collection orders created with your accounting package and sign to have them processed by the bank.

- Mandate management

Mandates allow outstanding invoices from your customers and other parties to be settled automatically. Manage your mandates and easily create collection files for SEPA direct debits.

This module allows users to view account information, receive reports electronically (CODA, SWIFT or XML formats) and request new accounts.

You can add or change these features for users:

- Itemised accounts

Create a clear distinction between funds belonging to you and other parties. Open, close and manage your itemised accounts (accounts for specific files or customers).

- Intraday account information

Daily information about accounts.

This module enables users to see any term investments and custody accounts.

You can add or change these features for users:

- Asset management report

If you have an investment portfolio managed by KBC Asset Management, you can see monthly reports including return-on-investment calculations, positions and transactions.

This module allows users to view the powers of attorney for accounts and request changes. Changes must be approved by a colleague authorised to do so.

This module allows users to request a new debit card and/or credit card.

You can add or change these features for users:

- View card transactions

View your credit card transactions and request billing statements.

- View card settings

View your payment card settings:

- Limits (debit cards only)

- Online payments

- International card use

- Contactless payments

- Manage card settings

Adjust your payment card settings:

- Limits (debit cards only)

- Online payments

- International card use

- Contactless payments

- Top up prepaid cards

Top up your KBC Business Prepaid Card(s).

After activating this module, you can add or change specific features for each user.

- Business property

- View the policy

This shows you details for each insurance policy (like cover and premiums).

- File a claim

If you’re covered for damage and your buildings are damaged unexpectedly, you can quickly and easily file an online claim here.

- View the policy

- Business operations

- View the policy

This shows you details for each insurance policy (like cover and premiums).

- File a claim

If you’re covered for damage and an important part of your business such as machinery suffers damage unexpectedly, you can quickly and easily file an online claim here.

- View the policy

- Vehicles

- View the policy

This shows you details for each insurance policy (like cover and premiums).

- File a claim

If you’re covered for damage and your vehicles suffer damage unexpectedly, you can quickly and easily file an online claim here.

- View the policy

- Persons

- View the policy

See insurance policy information like cover and premium details here.

- File a claim

This lets you submit accident claims, complete saved claims and send documents to KBC Insurance/CBC Assurances online.

- Accidents overview

This lets you track claims, view accident prevention information, and send documents for claims to KBC Insurance/CBC Assurances online.

- View the policy

- Group insurance and hospitalisation

- Overview of group insurance policies

This lets you see details of your group insurance, including insured categories and forms of cover. You’re shown personal and professional details for each member, including salary details, accrued pension reserves, contributions and insurance cover.

- Documents and files

This lets you access group insurance and/or group hospitalisation insurance files and documents such as contribution statements (including salary details). You can also add your e-mail address to receive a message whenever a new document is available.

- Manage employees

This lets you add new employees to your group insurance. You can also change a member’s details, such as when they leave employment, change their address or change their employment percentage.

- Annual registration of employee salaries

This is where you can check and update salary details for your group insurance when managing it each year.

- Manage notifications

You can enter the up to three e-mail addresses for receiving e-mail notifications whenever a new document becomes available.

- Overview of group insurance policies

This module enables users to see the loans and credit facilities taken out by your company. Separate powers of attorney are required to view them and make drawdowns.

You can add or change these features for users:

- Draw down Investment credit

If you’re planning a business investment, you can use your investment credit to finance this expense. Choose from the wide range of repayment options and specify the term. The interest and charges are both tax deductible.

- Local authority reports

If you work for a local authority, you can request reports on your commercial credit facilities. You can then use this electronic report and upload it into your municipality’s system.

Managing apps in your settings

You can quickly and easily request all apps online in your settings in the KBC Business Dashboard.

The request and approval process for Go&Deal Pro, eDocBox, KBC Invest for Business, ComFin Touch, KBC Business, Sustainability and Working Capital Insights is also entirely digital, which means the branch does not have to get involved.

- You can add new companies to the app if they are named in the Business Dashboard Agreement. Just go to your settings.

- If you want to add completely new companies to an app and they're not named in the Business Dashboard Agreement, you'll need to ask your branch for assistance in doing so.

As an administrator, you can add an additional administrator to an app by going to your settings. This will give them administrator privileges for the KBC Business Dashboard and they will have additional freedom to take care of administrative tasks though their settings in the same way as you.

Checking and managing powers of attorney for accounts in your settings

- All KBC Business Dashboard administrators can easily search for and view power of attorney details directly from their settings in the KBC Business Dashboard.

- A convenient filter feature allows you to search quickly by agent holding the power of attorney or by account.

Tip: you can also give other KBC-Online for Business users access to this feature. - If you not only want to search for and check power of attorney details, but manage them as well, you should contact your branch. They will be happy to tell you everything you need to know about the free e-powers of attorney app, which allows you to view, update and delete powers of attorney online and in real-time.

Requesting certificates

- Ten year liability certificate

- Occupational accident certificate

- Certificate attesting to the identity of the account holder

- Internal health & safety annual report certificate

- Certificate of customer standing

- Auditor's certificate

Communication

Our standard practice is to send documents in digital form to the company. Administrators, legal representatives and full mandate holders can easily view them in the document overview of the Business Dashboard.

The documents relate to all the companies in your Business Dashboard and include loan contracts, certificates, invoices and legal communications.

As an administrator, you can set up an e-mail address to receive e-mail notifications when:

- A payment cannot be carried out

- Important or legal documents are received

An additional benefit

As an administrator, you can create a link to your accounting software.

If you have any questions about the KBC Business Dashboard or are looking for more information, just click the link below to view our frequently asked questions: