What are green bonds?

Green bonds are bonds the proceeds of which are used exclusively to (re)finance projects which contribute to the environment and which comply with the Green Bond Principles (GBP).

Companies use these bonds to enable them to make the transition to a sustainable policy or to support their sustainable image.

What are the Green Bond Principles?

Since every bond can in principle be called ‘green’, the financial sector has taken a number of initiatives to clearly define this type of debt paper. The International Capital Market Association (ICMA) drew up the Green Bond Principles, a set of voluntary guidelines for transparent reporting on the issuing of green bonds, in order to provide investors with clear information on the characteristics of these bonds.

This requires a clear definition of four core components, viz.:

- Use of proceeds;

- Process for project evaluation and selection;

- Management of proceeds;

- Reporting.

A fifth component was recently added to this list, namely an external third-party review to confirm that the green bond complies with the foregoing core components. This may take the form of a review by a consultant, accreditation in accordance with a certain standard or achievement of a given score from a rating agency.

Why the need for green bonds?

On the one hand there are any number of social and green projects around the world which are waiting to be implemented by private or public-sector organisations. On the other hand, more and more investors are looking for sustainable investments which offer an answer to today’s challenges in relation to the environment and society.

Stakeholders in the financial sector, such as KBC, bring these two parties together, thus making sustainable projects possible.

Are green bonds new?

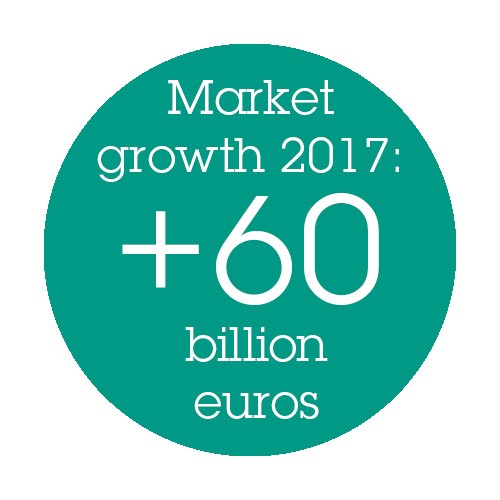

No; the European Investment Bank (EIB) pioneered the first issue of a green bond in 2007. Since then, the volume of green bonds has grown to more than 300 billion euros. In the past year alone, the market for green bonds grew by 60 billion euros, and the volume has already reached 40 billion euros in 2018.

What is KBC's role?

In 2014 KBC became the first Belgian bank to endorse the GBP as an underwriter (the intermediary between the issuer and the investor). Since then, KBC has been involved in several green bond issues. Among others, KBC has acted as Lead Manager for green bonds for GDF Suez, for a green private placement for Aquafin, and for the first green retail bond from Renewi.