Limburg-based Vasco made its name with high-quality designer radiators. But the construction market hasn’t stood still, so the firm has worked hard to identify new products and markets. ‘KBC’s network and digital tools mean we can quickly shift up a gear.'

Foreign business trips used to mean back-ups and temporary authorisations to sign for payments. With KBC Reach, I can simply make urgent payments myself via the app.

Peter Ketelslegers - CFO Vasco Group

Vasco was founded in 1975 by the industrialist Jos Vaessen, whose decorative radiators proved a big hit in Western Europe. This also attracted the attention of bigger players and after several years of robust growth, the company was taken over by the US construction group Masco. The radiator manufacturer returned to Belgian ownership in 2008, when Vaessen was given the opportunity to buy his firm back.

Vasco Group currently operates under the umbrella of Vaessen Industries, alongside E-max (aluminium frames), Kreon (lighting) and Limeparts (cladding). The family holding company employs almost 1 400 people worldwide with a turnover of 325 million euros. ‘Since the takeover, we’ve been investing heavily once again in new technologies and design – Vaessen’s two great focuses’, Vaessen Industries CFO André Bomans says. Synergies within the construction group are an additional advantage. ‘Together with our sister company E-max, for instance, we’ve developed a heating solution that follows the ‘cradle-to-cradle’ principle: aluminium designer radiators that are fully recyclable at the end of their operational life.’

Crisis at the market leader

Vasco Group is the leading player in the market, thanks in part to its emphasis on quality, innovation and design – its designer radiators have won a series of awards in several countries. The firm has been the Benelux market leader for some considerable time, and it also has sales branches in the Netherlands, France, Germany, Italy, Britain, Denmark and Poland. All the same, Vasco Group has faced a lot of challenges in recent years.

‘Demand fell during the financial and economic crisis’, the CFO of Vasco Group, Peter Ketelslegers, says. What’s more, the market for radiators in Western Europe is no longer growing. ‘Householders and businesses are investing more and more in effective insulation and passive design has become well established.’ This has impacted the building market and demand for heating systems. ‘In the 1990s, it took 25 kilowatts to heat the average home. The figure now is barely 5 kilowatts.

Passive homes as a new growth market

Rather than resting on its laurels, Vasco Group went in search of new growth markets. The firm has tapped new regions and has extended its product portfolio to include underfloor heating and ventilation systems. The latter in particular represent an important growth market, Ketelslegers explains. ‘The latest houses are so well insulated that they actually create a vacuum, which means poor air quality. Ventilation is crucial to newbuilds like that.

’Vasco has developed a whole range of silent, low-energy ventilation systems, focusing on models that offer heat recovery. These use the heat of the expelled air to warm up the fresh air, to minimise the amount of heat that is lost. Diversifying the product range has proved a good strategy. ‘We began with ventilation systems in 2012, but they’ve grown since to account for 12 percent of our sales.’

The firm’s ventilation systems are already being distributed in the Belgian, Dutch and Polish markets and Germany is next on the list. ‘That kind of international rollout isn’t easy, even though we already have branches abroad’, Ketelslegers acknowledges. A ventilation system comprises a central unit and air ducts that have to be cast into the screed. The technical plans are drawn up by the back office in Belgium, but selling the systems also requires specific technical knowledge. ‘That means we have to retrain our sales staff too.’

Smart cash management

Vasco Group’s international sales branches are all separate companies with their own, local accounting. ‘The international network of our main bank, KBC, was very helpful in that regard’, they say at Vasco Group.

In addition to Belgium, KBC’s home markets are the Czech Republic, Slovakia, Bulgaria and Hungary, and the bank also has an international network, with offices in various Western European countries, the United States and Asia, so it can truly support clients with international interests. KBC opens accounts and manages all the foreign ones on the client’s behalf. ‘That means we have a single point of contact in Belgium, which is really handy’, Bomans says.

The needs of our corporate clients don’t stop at the border, so our services shouldn’t either.

Jan De Rop – KBC Payments Adviser

Vasco Group also relies on KBC for its cash management. ‘Thanks to a cash-pooling system, the balance of all the accounts flows each day to a single central account, which is linked in turn to a credit line. Not only does that make it a whole lot easier to manage our cash, it also reduces our costs, as the positive and negative balances of the various accounts offset one another.’

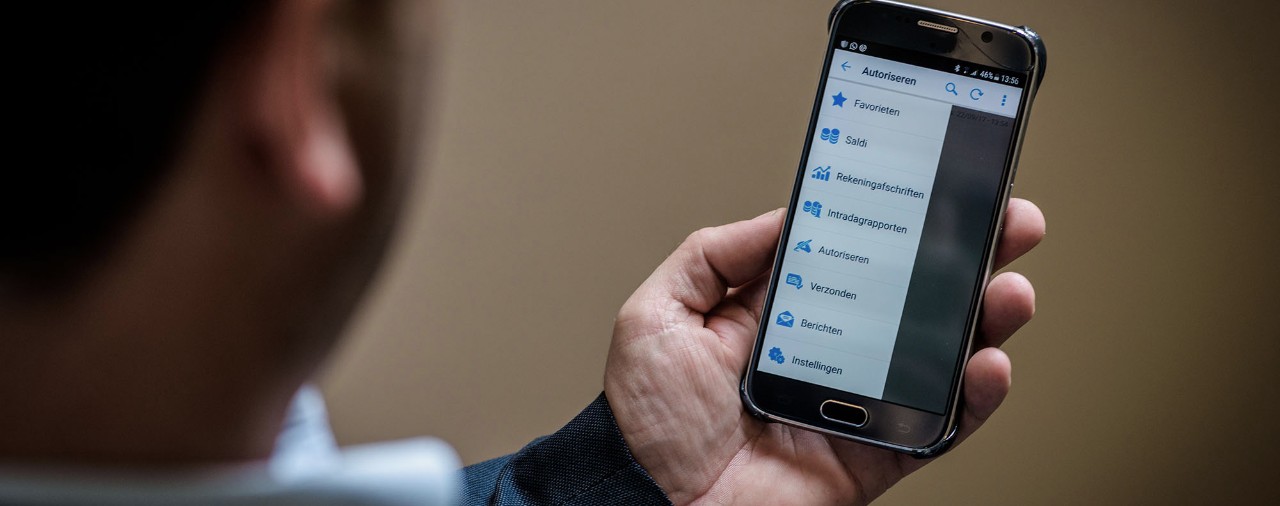

Innovative KBC Reach tool provides overview of all accounts worldwide

For the past year, Vasco Group has been using the KBC Reach application to manage the accounts. The tool is an innovative one, KBC Payments Adviser Jan De Rop stresses. Not only does KBC Reach provide an overview of all a company’s national and international accounts, company managers can also use the application to check accounts and approve payments via their mobile devices.

Peter Ketelslegers wouldn’t be without it now: ‘Thanks to KBC Reach, I can quickly check whether or not a client has paid.’ The system also eliminates a lot of paperwork. ‘We have a factory in Poland and sales offices in several different countries, so I have to travel abroad regularly. Signing payments with the laptop or via back-ups and temporary authorisations used to be a real hassle. With KBC Reach, I can now simply make urgent payments myself using the mobile app.

The KBC Reach ‘super-user’ concept enables firms to manage their authorisations themselves. ‘We have strict rules at Vasco Group when it comes to outgoing payments. Two people always have to sign for any amount higher than 5 000 euros’, Bomans says. ‘Until a year ago, that always meant a trip to the bank to sign a stack of papers. Now we can take care of it ourselves via Reach.’

An important technical benefit offered by KBC Reach is that the system supports a large number of software formats, from the output of different accounting systems and technical files from the payroll managers, to international payment formats. ‘For us, that was non-negotiable’, Bomans stresses.

Ambitious plans abroad

Following the successful launch in its domestic market, Vasco Group is now ready to roll out its silent and innovative ventilation systems in the rest of Europe. Meanwhile, new markets for its radiators are being tapped in Eastern Europe too. The heating and ventilation specialist is also planning, lastly, to expand its production capacity abroad.

‘KBC Corporate Banking is an important partner in this international narrative’, Bomans says. ‘Their local contacts have helped us move with the necessary speed. They reduce our administrative costs. And it’s also great to have a central point of contact for our international accounts.’

‘Our clients’ needs don’t stop at the border’, KBC’s De Rop concludes, ‘so our service shouldn’t either’.