Supplementary pension

Build up additional retirement income for your employees for later

When you have a business, you want to be able to secure a good future not just for yourself, but for your employees too. One way to do that is to provide an ‘income’ in retirement. Our flexible and tailored pension solutions provide peace of mind and financial security, as well as enhance your appeal as an employer.

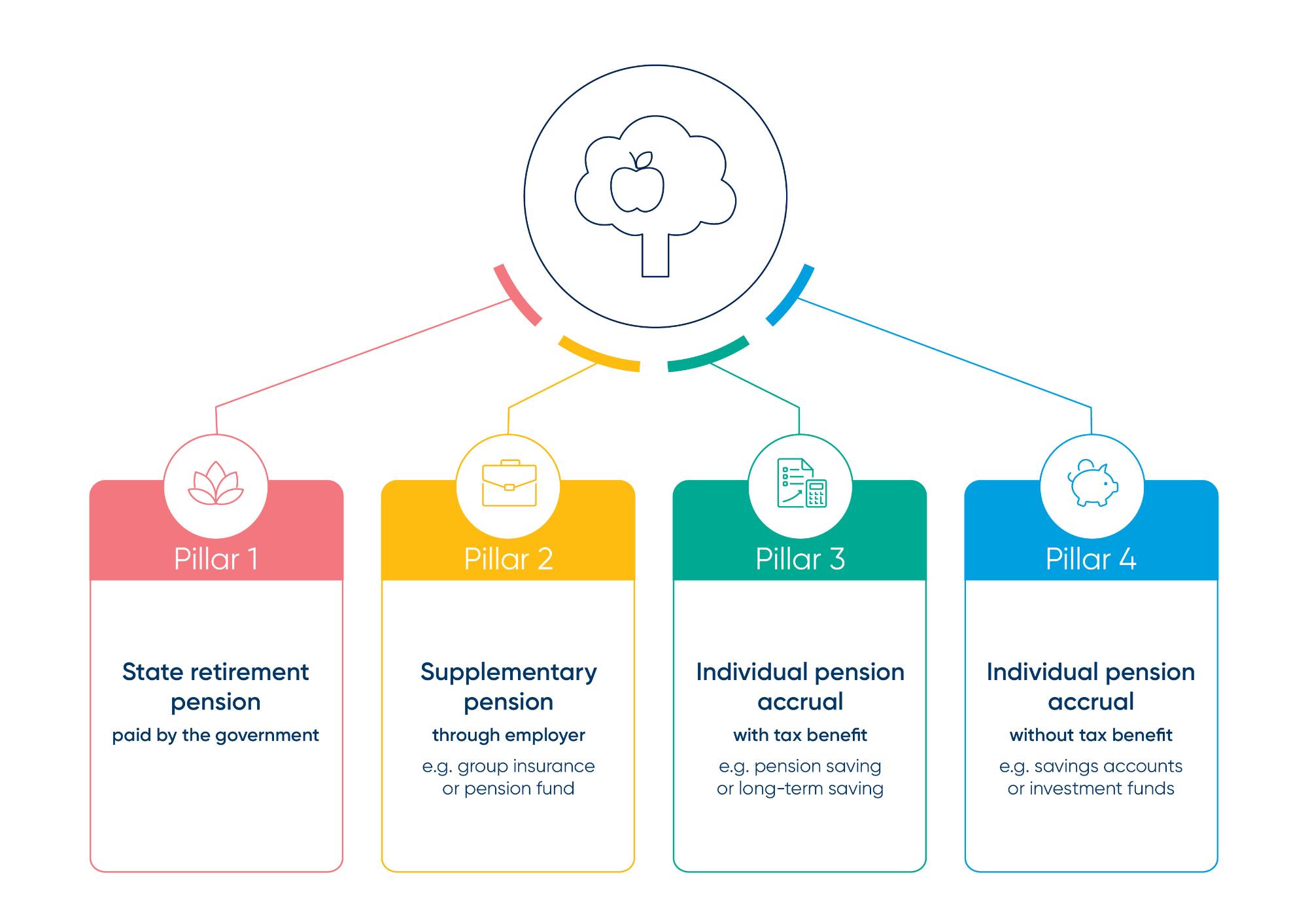

Four pillars constitute your employees' pension

Why should you set up a supplementary pension scheme?

With an ageing population exerting ever more pressure on state retirement pensions, supplementary pensions are becoming increasingly important.

For employers, offering a supplementary pension is a tax-efficient alternative to giving a salary increase.

It also helps your employees support themselves more effectively when they retire. When you look at the cost of staying in a residential care centre in 2025, it averages out at 2 100 euros a month whereas the average state pension is barely 1 479 euros.

A pension plan provides more net final capital than a salary increase

Suppose, as an employer, you provide a budget of 1,000 euros for a monthly pay rise, which for an employee means a pay rise of 785 euros gross per month. After deducting social security contributions and taxes, that leaves a net of 365 euros per month.If, as an employer, you invest 1,000 euro a month in a pension fund or group insurance, this leaves a net capital amount of 722 euro a month for an employee who retires on the legal retirement date, after deduction of taxes and costs. To this is added the interest accrued over the entire term of the contract.

Should you opt for a group insurance scheme or a pension fund?

As an employer, you have control at all times

You decide which staff category gets a pension fund or group insurance scheme, as well as the budget to be allocated to it.

The contribution amount is fixed (i.e. either a percentage of the salary or a fixed amount), ensuring that you always know exactly what it will cost you.

Which pension solution would be the best fit for your organisation?

The pension solution that suits your organisation best depends on a number of factors, including the size of your company and its appetite for risk.

Class-21 group insurance is the ideal solution for small businesses. Not only does it have a lower financial entry threshold, it also offers more security and stability thanks to its guaranteed rate of interest and the potential to earn a profit share.

Pension funds are the ideal solution if your business can handle a bit more volatility, meaning you can take on more risk with a chance of earning a higher return. You can also determine the risk profile of the investment portfolio yourself. KBC takes the complex administration, legal obligations and actuarial management of a pension fund off your hands, allowing you to stay actively involved and to fully focus on your core business activities. KBC ensures that the strength of a pension fund, once only available to the biggest players, is now accessible to all medium-sized enterprises.

Or KBC experts are on hand to help you make the right decisions.

Discover KBC Employee Care

Need more information?

If you’d like to hear more about KBC's pension solutions, come and talk to us. We’ll be happy to set aside time for you.