Verification of Payee and instant credit transfers

Transfers are even faster and more secure

- Make transfers more securely

- Prevent fraud and errors

- Choose the fastest method (24/7 on any calendar day)

New Instant Payments Regulation: how will this affect you?

All euro area banks perform an additional check in which they verify the beneficiary name, otherwise known as ‘Verification of Payee’. KBC also checks whether the name and account number of your beneficiary match the details in the beneficiary bank’s records. We do this for all traditional and instant credit transfers.

Within five seconds, you will be informed whether the payment was successful. If there’s a problem, you’ll be notified and you can choose what to do next – you can check the beneficiary's details and update them, or continue with the transfer.

This scheme is part of the new Instant Payments Regulation and is aimed at enhancing security for transfers and preventing fraud and incorrect transfers.

It’s now even easier to check your batched payments to confirm that the Verification of Payee is correct. Our dedicated tool allows you to check the details first, after which you can continue processing the payments with peace of mind.

As a user, you’ll receive an e-mail with an activation link between 9 and 11 March. The link is only valid for only 30 days, so be sure to activate it as soon as possible.

Our demo video explains exactly how the check works and the notifications you can receive, and you can read our frequently asked questions for further details.

This is an embedded video from YouTube. Viewing this video may cause YouTube to add or read cookies. Please give your explicit consent before viewing. For more information, see our cookie policy..

2. Instant credit transfer: make transfers faster

An instant credit transfer means the money is deposited into the beneficiary's account immediately, 24/7 (i.e. including at night, on weekends, public holidays and bank holidays). Batched payments can also be processed 24/7.

Your batched payments are processed as a traditional credit transfer by default. If you want your batched payments to be processed instantly, you can indicate this in the batched payment using the ‘Local Instrument Code’ field. If an instant credit transfer fails, your transaction will be declined and the amount will be credited back to your account. You can then make your transfer as a traditional credit transfer.

Check our frequently asked questions for even more information about instant credit transfers.

Frequently asked questions about Verification of Payee

No additional costs are charged for checking the name and account number at the beneficiary bank.

All KBC customers who use our digital applications (such as KBC Mobile, KBC Touch, KBC-Online for Business) use this service automatically.

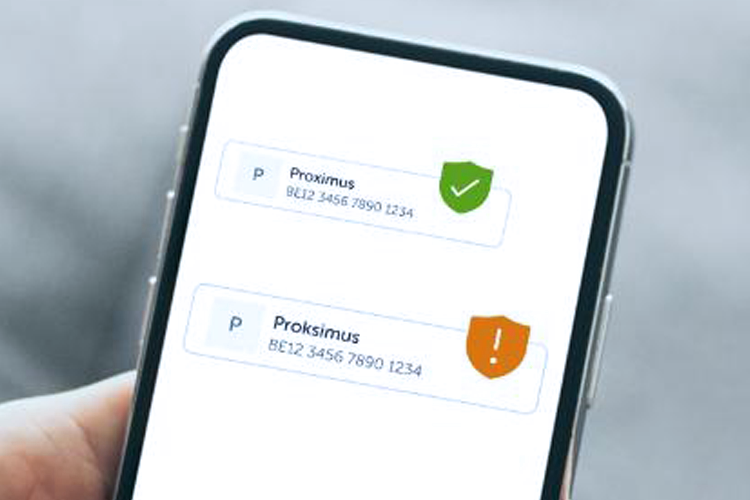

After a transfer, you will receive one of the following three notifications: a green, orange or grey notification shaped like a shield.

Green notification

When you see a green notification when transferring money to a person or a company, it means the name and account number you entered match the details in the beneficiary bank’s records. We perform this additional check to confirm whether the details are accurate and it is safe for you to transfer the money.

Orange notification

The name and the account number do not match. This can mean two things:

- The details are a close match: you will receive an orange notification if the beneficiary’s name differs slightly from the name in the beneficiary bank’s records. Perhaps there was a typo in the information you entered: for example, ‘Jansens’ instead of ‘Janssens’. The notification will contain a suggestion for the correct name. Always check whether the name suggested is the correct name.

- The details are not a match: you will also receive an orange notification if the name and account number you entered do not at all match the details in the beneficiary bank’s records.

Grey notification

In certain cases, we may be unable to check whether the name and account number entered match the details in the beneficiary bank’s records.

You can receive a grey notification for various reasons:

- We, our partner performing the check or the beneficiary bank could be experiencing technical difficulties.

- It may also be the case that the beneficiary bank doesn’t offer this additional check yet or the account may have only just been opened.

Always check the name and the account number.

If you continue with the transfer without making any changes, the amount could be sent to the wrong beneficiary. You will be liable for the transfer if it is fraudulent.

What to do if you suspect fraud or have doubts about a payment

If you’ve fallen victim to fraud or suspect this might be the case, it’s important that you immediately contact Secure4u, our fraud department. You can call them 24/7 on 016 432 000.

Checking the name entered takes no more than five seconds. You will usually receive a notification straight away.

Transfers to personal accounts

- Be sure to enter at least the surname in the beneficiary field

- Contact the person or company you are transferring money to and ask for the full name of the person or company

Transfers to business accounts

Check the details and, if necessary, contact the beneficiary (note that contact details on a forged invoice may also be fake).

Yes, you can. You always decide whether to proceed with the transfer. We do note that, if you choose to proceed with the transfer after receiving an orange or a grey notification without changing any details, you will be liable for the transfer if it is fraudulent.

For private individuals, we will check the surname and first name of all account holders (in other words, the people linked to the account). In case of a typo, we will only show the name of the account holder whose name you entered.

For legal entities, we will check the legal names registered with the beneficiary bank as well as any legal abbreviations registered with the bank.

If you hand in a transfer form at your KBC branch after November 2025, your transfer will not be checked. In exceptional cases, if we process the transfer, we will check the beneficiary’s name while you’re there.

We will check the name entered against the name we have on record (the legal name).

If the name is a match, your payer will receive a notification shaped like a green shield and the payment can proceed. If the name is not a match, an orange shield will be shown.

When your payer sees a notification, they may have some concerns. The best way to avoid unnecessary questions and delays is to make sure the name on your invoices is identical to the name we have on record.

In the near future, we will be able to check not only legal names but also commercial names. Therefore, we recommend that you also register your commercial name in the CBE database.

Yes, it is. Before signing the transfer, you will receive a notification informing you whether the name linked to the account number matches the name the beneficiary bank has on record.

That depends on the situation.

- We will never show the name of a private individual when you only enter the account number for a transfer. Only if there are slight differences in the name, for instance if it contains an obvious typo, do we show the name the beneficiary bank has on record (for example, ‘Jansens’ instead of ‘Janssens’).

- For transfers to legal entities, we will show the legal name.

No, it doesn’t. Erroneous collections can be refunded on request up to 8 weeks after the amount has been debited and, in the event of fraud, up to 13 months after the amount has been debited.

- Foreign-currency payments

- Bank card payments

- If the beneficiary’s IBAN number and name are not manually entered by you

- Direct debits

Yes, it is. The check is performed when setting up the standing order.

- Please note that once you’ve signed the order, we do not perform the check on any subsequent transfers.

- Standing orders set up in the past are not subject to this check either. The check is only performed when setting up the order.

No, the check is only performed on SEPA credit transfers. This means that transfers in currencies other than the euro are not subject to this check.

If you have only recently opened a new account or if the name on your invoice is not identical to the name we have on record, payers may receive an orange or grey notification when transferring money to you. The best way to avoid unnecessary questions is to make sure the name on your invoices is identical to the name we have on record.

Do you have a company?

- If so, be sure to include your company's full legal name and legally recognised abbreviation on your invoices (in addition to your trade name).

- Where necessary, update your registration in the CBE database by also entering trade names, not just the name and abbreviation appearing in the Articles of Association.

Are you a sole trader?

- The payee will not be verified based on the trade name, but on your personal name. Even if your trade name is registered in the CBE database, the check will still be performed on your personal name.

- Make sure that your personal name is included on the invoice in its invoicing details, so that the customer can enter those details when transferring money to you (do not use the trade name).

We are currently assessing how to proceed with batched payments.

You can register your details in one of two ways:

1. Update your details directly in the CBE database via MyEnterprise:

- Log in with itsme® or your eID (only your company’s legal representative has access)

- Add your trade name under ‘Entity details’

- You’ll receive confirmation by e-mail or in your mailbox

Learn more on the FPS Economy site.

2. A business one-stop shop known as a ‘business counter’ will take care of the registration for you.

You can find a counter near you at weblist.economie.fgov.be/en/business-counters.

Important:

- Enter the commercial name of your company (not of your establishment units).

- The CBE sends your details to SurePay just once a month, on each first Sunday. It is only then that your new or modified trade name will be used when required for verification purposes.

Are you a legal entity?

We take account of the commercial name that you’ve registered in the CBE database for verifying the payee's name.

Are you a sole trader?

In that case, the payee will not be verified based on the commercial name, but on the surname and first name of the account holder(s).

FAQ's: VOP Bulk Portal

General

The VOP Bulk Portal is a secure, standalone application that lets you verify the account number (IBAN) and beneficiary name for multiple SEPA credit transfers included in a single batched payment. This verification is performed before you initiate and authorise the batch using one of our payment applications (such as KBC Reach or KBC-Online for Business).

Access to the portal is granted to payment application users who have the appropriate permissions and who have registered their professional e-mail address in the KBC Business Dashboard.

There is no technical limit.

The cost of using this portal is included in the price of your e-channel (KBC Business Dashboard, KBC-Online for Business, KBC Reach, MultiConnect or Tessi).

Your data is processed in a highly secure, closed environment that fully complies with European and Belgian security and privacy requirements.

Your data is processed in a highly secure, closed environment that fully complies with European and Belgian security and privacy requirements.

Logging in

Your data is processed in a highly secure, closed environment that fully complies with European and Belgian security and privacy requirements.

Start by checking whether you’ve registered your professional e-mail address in your KBC Business Dashboard profile.

You should also check your spam or junk e-mail folder.

If everything is correct and you still haven't received an invitation, send an e-mail to vop@kbc.be to request a new invitation.

- Log in to the KBC Business Dashboard and open your settings via the cogwheel icon

- Click the ‘Your Profile’ tile

- Click the ‘Your Professional Details’ tile

- Enter your e-mail address

- Sign to save the changes

There are two types of invitation links:

1. The first invitation link sent at the beginning of the process will expire after 30 days.

2. Any subsequent invitation links will expire after 30 days.

If your link has expired, send an e-mail vop@kbc.be to receive a new invitation.

Yes, you can. You can log in with the other organisation by following the steps below:

- Accept the invitation.

- Instead of creating a new password, click ‘Log in’ and enter your existing details in order to be activated for the new organisation as well.

- Once you’ve been added, you can choose between different organisations after logging in.

Multi-Factor Authentication (MFA) is a security feature that protects your account by requiring more than one form of authentication when you log in.

Instead of just a password, MFA asks for additional confirmation. We do this with a notification sent to an authentication app (such as Google Authenticator).

MFA is important because

passwords can be stolen, guessed or leaked.

MFA adds an extra layer of security so that someone with your passwordwill still be unable to gain access without the second authentication step.

How does it work?

- You enter your username and password

- You confirm your identity through a second step, for example by approving a notification on your phone

- Following successful authentication, you can securely access your account

Send an e-mail to vop@kbc.be to request a reset of your MFA.

After it is reset, you will need to reconfigure MFA when you log back in.

Yes, you can. Select ‘Remember this device’ while logging in.

This will register your device as ‘trusted’ for 30 days.

- Go to the login screen

- Click ‘Forgot password?’

- Enter your e-mail address and follow the link you receive by e-mail to set a new password

Click your profile icon at the top right and choose ‘Sign out’.

Checking batches

- Go to the ‘File Check’ tab.

- (Optional) Download a template file in Excel or CSV format.

- Click ‘Browse’ or drag your file to the upload box.

- Wait until the status ‘Processed successfully’ appears or check any error messages.

You can upload batched payments in the following formats:

- Excel (.xlsx)

- CSV (separated by semicolon)

- PAIN.001 XML (versions 001.03 and 001.09)

- Use semicolons (;) as a separator in CSV

- Place names with special characters in inverted commas

- Avoid empty rows or merged cells

- Use UTF-8 encoding for CSV files

- Make sure there are no formulas or macros

- Stick to the defined column structure, even for unused fields

This means your file was uploaded correctly and is waiting to be processed. Once processing is complete, this status is updated automatically.

No, you will not receivea separate notification.

However, the batch status will be updated and you can download the result as soon as it is available.

Once the batch has been processed, you will find it on the right-hand side of the ‘File Check’ screen.

- Click ‘Download File’

- Choose the desired format (Excel or CSV)

- The file will be saved in your default download folder

Yes, you can. You can see and download all file checks uploaded by users within your organisation.

- Match: MTCH: Exact match found

- Close Match: CMTC: Similar name found, suggestion available

- No match: NMTC: No match, suggestion possible

- Not Able to Match: NOAP: Matching not possible (e.g. PSP not participating, name too short)

We provide information about the beneficiary. If the result is not a match, we recommend checking the payee's details and correcting them (if necessary) before you execute the batched payment in our payment applications.

If you decide not to make any changes, you accept full responsibility for the payment and acknowledge that no refund can be claimed in case of fraud.

These are ‘row-level errors’. A result file is still being generated.

Columns display error information such as Error Type, Error Code and Error Detail.

Common row-level errors and solutions:

- MANDATORY_FIELD_NOT_PROVIDED: A mandatory field is missing. Solution: Fill in all mandatory fields

- INVALID_FIELD: Invalid field format. Solution: Check if the format follows the rules

- NAME_TOO_LONG: Name too long. Solution: Shorten the name to max. 140 characters

- MUTUALLY_EXCLUSIVE_FIELDS_USED:Conflicting fields have been filled in. Solution: Choose either the name or organisation ID

You will see a ‘file-level error’ in the portal.

Common causes include:

- Mandatory columns missing

- Incorrect file structure

- Temporary unavailability of service

(These appear in theresult file at transaction level.)

- 500 – Internal Server Error: Try again later or contact vop@kbc.be if the problem persists.

- 503 – Service Unavailable: This is likely maintenance. Wait until after maintenance is complete and try uploading again.

- 504 – Gateway Timeout: A bank did not respond within the statutory VOP deadline. Try the entry again with a new file check.

For batched payments approved and executed by the customer through KBC Reach, the bank guarantees the accuracy of the obtained verification result for a period of two weeks following the completion of verification.

KBC accepts full responsibility if the communicated verification result is nevertheless found to be incorrect within this period.

At the end of this two-week period, the guarantee applying to the verification result expires, and the customer must resubmit the relevant batches for verification.

Frequently asked questions about instant credit transfers

When you make a traditional credit transfer, the money is into the payee's account no later than the next banking day.

When you carry out an instant credit transfer (always in euros), the money is credited to the payee's account within seconds (10 at most), 24/7 (including at night, on weekends, public holidays and bank holidays).

There may be several causes. For example, this could be due to a technical problem, the payee's bank not accepting instant credit transfers, or because the payee's account has been closed.

Instant credit transfers are carried out at no extra charge.

The money is available to the payee in seconds when transferred this way.

Yes, instant credit transfers can be made to foreign account numbers within SEPA*, provided the payee's bank is able to receive this type of transfer. Overview of countries where banks must be able to receive instant credit transfers:

- EEA (euro): mandatory from 9 January 2025

- EEA (other than euro): mandatory from 9 January 2027

- Other SEPA countries: optional

More detailed information can be found in this EPC Document.

*Find out more about SEPA at What is SEPA? What does it entail for me as a business owner? – KBC Banking & Insurance

Euro-denominated payments made from a euro payment account within SEPA are already possible.

The following capabilities will become available in the future:

• Euro-denominated payments from a non-euro payment account within SEPA

• Payments in payments diary (until then, scheduled payments will continue to be processed as traditional credit transfers. Saturdays and Sundays cannot currently be selected.)

• Standing orders (until then, standing orders will continue to be processed as traditional credit transfers. However, you can select a non-banking day and your account will be debited accordingly, but the payee's account will not be credited until the next banking day.)

No, it cannot. The amount is typically credited to the payee’s account in a matter of seconds.

This means that instant transfers cannot be cancelled.

If you still want to revoke the payment, you should contact the beneficiary.

The same limits apply as for traditional credit transfers.

In addition, the limit for outgoing instant credit transfers is 1 000 000 euros. Any transaction higher than 1 000 000 euros cannot be carried out as an instant credit transfer.

Yes, any KBC customer can carry out instant credit transfers using the online channels. As from 9 October 2025, you can choose between instant and traditional credit transfers in KBC Mobile and KBC Touch. Starting 27 October 2025, you can also go to your bank branch and make an instant credit transfer.

The channels where you currently have this choice will be expanded further in the near future. At present, you also have the option of transferring money instantly in KBC-Online for Business, the KBC Business app and KBC Reach.

Yes, they can. As from 9 October 2025, instant credit transfers will be possible from any type of euro payment account held at KBC.

Yes, KBC has long supported instant credit transfer processing, thus enabling you to receive such transfers on your KBC accounts. The processing speed (instant/traditional) is always provided in the transaction details.

KBC Mobile & KBC Touch

As from 9 October 2025, unless otherwise stated.

At KBC, you can choose between instant and traditional credit transfers. All transfers in KBC Mobile and KBC Touch are processed as instant credit transfers by default.

If you adjust the execution speed in the general settings, that setting will be applied to all new credit transfers.

For each individual transfer, you can always change the speed for that specific transaction.

If an instant credit transfer fails, you can either cancel it or have it carried out as a traditional credit transfer.

You are free to choose the speed of execution for each one of your transfers.

If we fail to receive a status update on the initiated instant credit transfer within 10 seconds, you’ll see a screen notifying you that the status of the transfer is not yet known. However, as soon as its status comes through, you’ll be notified as follows:

• KBC Mobile: in a message displayed under ‘For you’ (as from 9 October 2025), via the newsfeed and a push notification (as from 9 December 2025 in both cases)

• KBC Touch: in a message displayed under ‘For you’ (as from 9 October 2025)

If the instant credit transfer ends up not going through, the amount concerned will be paid back into your account*.

*from 27 October 2025 (until then, the transaction will disappear from your account overview).

Yes, you can.

Kate always carries out your transactions as quickly as possible. That means payments are instant if that’s an option, otherwise we automatically switch to a traditional credit transfer. You don’t need to do anything.

In the near future, %%product.kate% will also give you the choice between making an instant or traditional credit transfer.

Yes, you can.

From 9 December 2025, your selected execution speed (instant or traditional) will also apply to the remittance folder.

Yes, they can. As from 9 December 2025, the person initiating the

credit transfer can specify whether it should be an instant or traditionalcredit transfer.

The last signatory will then receive feedback on the result (whether or not it was successful).

If instant processing is not possible, the last signatory can opt for traditional processing, without the previous signatories having to re-sign.

Online for Business and KBC Business

From 23 February 2026.

Only for debiting KBC and CBC accounts.

At KBC, you can choose between instant and traditional credit transfers.In KBC-Online for Business and the KBC Business, transfers are processed as instant credit transfers by default.

You can adjust the execution speed in the general settings of KBC-Online for Business.

This setting will apply to all new credit transfers in both Online for Business and the KBC Business.

For each new credit transfer, you can still adjust the execution speed per transaction.

* The default execution speed can be configured in the general settings per company.

KBC-Online for Business

If the instant credit transfer fails, you can choose between two options:

• Cancel the transfer

• Proceed with a traditional credit transfer

You are free to choose the execution speed for each transfer.

KBC Business

If the instant credit transfer fails, you can re-enter the transfer.

KBC-Online for Business

After signing the transfer(s):

• The instant credit transfer was successful

A green pop-up will confirm that the instant credit transfer(s) have been successfully processed.

You will be immediately redirected to the ‘Processed payment orders’ screen.

• The instant credit transfer failed

An orange pop-up will show the number of instant credit transfers that succeeded and those that did not.

You will then be shown the ‘Failed instant credit transfers’ screen.

You can then try again as a traditional credit transfer.

Instant credit transfers that cannot be reattempted as a traditional credit transfer will appear on the ‘Failed transfers’ screen.

KBC Business

If an instant credit transfer fails, you will receive a push notification referring to a Combox message with the details.

If we do not receive a status notification about the initiated instant credit transfer within 10 seconds, the status ‘Payment unknown’ will appear in KBC-Online for Business .

Once the status is known, you will receive a Combox message with the result of the payment.

In the KBC Business, you will receive a push notification as well as a Combox message if it appears that the instant credit transfer failed.

Yes, you can.

Kate always carries out your transactions as quickly as possible. That means payments are instant if that’s an option, otherwise we automatically switch to a traditional credit transfer. You don’t need to do anything.

In the near future, %%product.kate% will also give you the choice between making an instant or traditional credit transfer.

KBC Reach

From 23 February 2026.

For: KBC BE and CBC accounts and KBC Italy, KBC France, KBC Germany, KBC Netherlands, KBC UK.

At KBC, you can choose between instant and traditional credit transfers. In KBC Reach, transfers are processed as instant credit transfers by default.

For each new credit transfer, you can still adjust the execution speed per transaction.

* The default execution speed can be configured in the general settings per company.

After signing the initiated instant credit transfer, you will return the page you were workingon.

If an instant credit transfer fails:

· a pink pop-up stating that processing failed will appear in the top right corner

· this pop-up will contain a link to the ‘Transmitted payments’ screen, where you can see more details about the instant transfers that failed

You can then create a new transfer with the same details but with ‘traditional’ execution speed.

Batched payments

From 9 October 2025.

Available in the following channels: KBC Online for Business, KBC Business, KBC Transfer, SWIFT for Corporates and the PSD bulk channel.

Yes, this can be done by adding the note ‘INST’ to the ‘Local instrument code’ field at the ‘Payment Information’ level*. If this field is not filled in, has a value other than ‘INST’ or if the ‘Local instrument code’ field is only filled in at the ‘Transaction’ level, the traditional credit transfer process will be applied.

This is processedas a traditional credit transfer if this field:

· is not completed

· contains a value other than ‘INST’

· has been completed only at transaction level

*The 'Local instrument code' field is shown at both the ‘Payment information’ and ‘Transaction’ levels. The instruction to carry out an instant credit transfer will only be executed when this is included at the ‘Payment Information’ level.

At KBC, an instant credit transfer is possible for all pain.001 versions (version 2, 3 and 9).

N.B.: Batched payments processed as instant credit transfers are processed 24/7, but not immediately. The timing of the processing will depend on the size of the file and the number of transfers that can be processed.

Each batch is first

converted into individual paymenttransactions before being executed.

This conversion takes place one transaction at a time, so large batches may take a while.

It is therefore possible that batches submitted late in the evening might not be fully converted, processed and executed before the next day.

Yes, you can view this in:

- KBC Online for Business by checking the details of the batched payment or the notifications under ‘New for you’

- KBC Reach under ‘Cash Management’

- Coda & Camt by checking the (debit/credit) account status

- Pain002

If instant processing isn’t possible, the transactions will be rejected. You must reinitiate the failed transactions yourself.

In Online for Business, you can track the status by checking the details of the batched payment. For other channels, you can track the status by checking the (debit/credit) account information.

If you submit a batched payment before 2.30 p.m.* on a banking day, the beneficiary bank will receive the bank transfers on the same day.

If you opt to pay for ‘Urgent’ processing, this can be done until 4 p.m.** at the latest for batched payments with a maximum of 1 transaction.

* A transfer order is only fully submitted to us once you’ve signed and sent it to KBC correctly, we’ve received it and the amount can be debited from the account (on any weekday apart from 1 January, Good Friday, Easter Monday, 1 May, and 25 and 26 December).

** Until 4.25 p.m. at the latest in KBC Reach.

The ‘Urgent’ option is still available.

We will continue to provide daily reporting at no additional cost.

That includes at weekends and on public and bank holidays, and applies to all report-related services offered, i.e.:

- CODA

- SWIFT MT94x

- CAMT.05x

- Isabel

You will continue to receive account statements in CODA, CAMT or MT format.

Participating KBC accounts in Belgium are zero-balanced every calendar day, including at weekends and on public and bank holidays. For foreign KBC accounts, nothing will change at this time, i.e. participating accounts are only zero-balanced on business days.

From 23 February 2026, instant batched payments will also be possible through these channels.

· Tessi and Multiconnect follow the same procedure as described above.

· For Cedacri, enter the code ‘FAST’ at Service Level.

Payments made through your bank branch

Available from the end of November 2025.

The default execution speed for credit transfers made through your bank branch is that for traditional transfers. If you want to make an instant credit transfer at your bank branch, the staff member there can initiate the transfer for you. After the transfer instructions have been entered, the member of staff will receive feedback on the status of the transfer within 10 seconds, i.e. whether it’s been processed instantly or not. They will communicate that feedback to you right away. This means you must wait at the branch until the staff member can give you this information.

As soon as the status of the transfer comes through, a member of staff in our branch will contact you and tell you whether the instant credit transfer was successful or not.

If the instant credit transfer ends up not going through, the amount concerned will of course be paid back into your account.

.png)

.png)

.png)