De premies voor je (sociaal) VAPZ blijven fiscaal aftrekbaar in 2026.

Ook al heb je door de coronacrisis 1 of meerdere kwartalen betaaluitstel aangevraagd voor je sociale bijdragen.

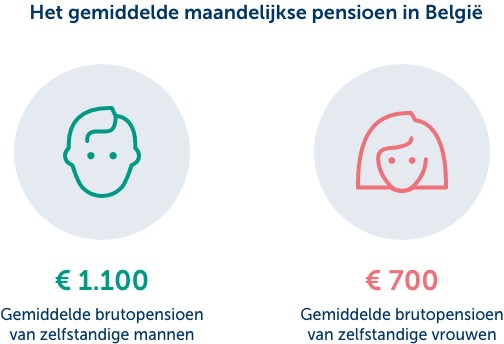

Het gemiddelde wettelijke pensioen voor zelfstandigen is 911 euro per maand. Dat ligt in vergelijking met een werknemer in de privésector een heel stuk lager. Je betaalt als zelfstandige namelijk minder sociale bijdragen tijdens je loopbaan, een belangrijke maatstaf voor de berekening van het wettelijke pensioen.

Wil je je huidige levensstandaard behouden, heb je dus alle belang bij een aanvullend pensioen. En tegen fiscaal optimaliseren en ondertussen je pensioen opbouwen, zeg je toch niet nee?

Hoe pik je fiscaal voordeel mee?

Of je nu een vennootschap hebt of niet, je zou gek zijn om het fiscaal voordeel te laten liggen.

Daarbij hoef je je niet te beperken tot één vorm van aanvullend sparen.

Bekijk je mogelijkheden hierna en combineer verschillende pensioenspaarvormen voor een optimaal fiscaal voordeel!

Nu meer fiscaal voordeel, later meer reserve

Ondervind nu al de voordelen van sparen in een aanvullend pensioenplan! Je betaalt minder belastingen, want je maakt fiscaal aftrekbare beroepskosten. Daarnaast:

- Kun je korting krijgen op sociale bijdragen

- En je kunt een voorschot opnemen op je opgebouwde reserve, om vastgoed te kopen of te verbouwen.

Meegenomen, toch?

Moeilijke keuze? We helpen je graag!

Heb je liever gepersonaliseerd advies?