‘Arizona’ Coalition Agreement: practical details of tax plans for investors

Update 26-01-2026

In this post, we take a closer look at the further details of the tax plans and how they will affect investors, both private individuals and entrepreneurs.

More information on capital gains tax for entrepreneurs.

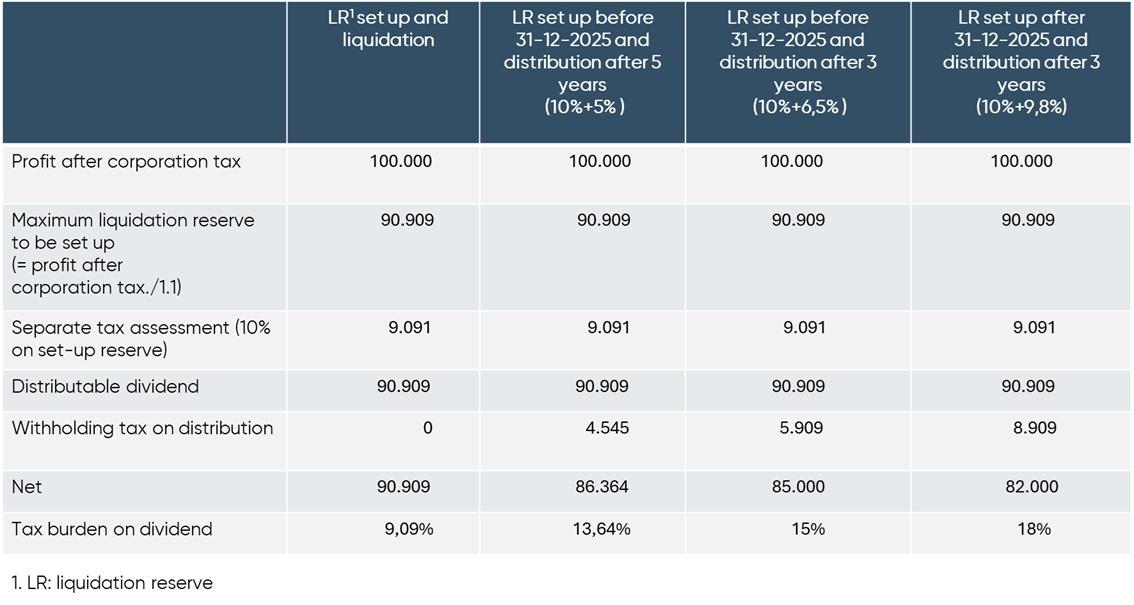

- Under the original regime, existing liquidation reserves (and also liquidation reserves created in the financial year with assessment year 2025 and with closing date no later than 30 December) can be distributed after a waiting period of five years at a withholding tax rate of 5% Net tax burden: 13.64%

- It is also possible to opt for a three-year waiting period before distribution of the liquidation reserves. In that case, however, 6.5% withholding tax will have to be paid upon distribution. Net tax burden: 15%.

- The new rate increase agreed in the Budget Agreement (raising the total tax burden to 18%) would not apply to these previously accumulated liquidation reserves.

- For reserves created on or after 31 December 2025 (assessment year 2026 onwards), the waiting period would always be three years. However, under the recent Budget Agreement, the total tax burden on these reserves would rise further to 18% (by raising the withholding tax rate on distribution after three years to 9.8%).

- On liquidation, no further tax is currently due on liquidation reserves. This would continue to be the case. We would add the comment that the intention cannot be to liquidate a company in order to then set up another company with (almost) the same object (and certainly not within a period of three years).

Entrepreneurs will have to carefully weigh up what is most advantageous in their specific situation with regard to liquidation reserves that have already been created: accelerated distribution at a withholding tax rate of 6.5% (if there are liquidation reserves that were created three or four years ago) or waiting until the five-year period has expired and then distribution at a withholding tax rate of 5%. Many factors come into play here: how quickly and for what purpose the entrepreneur needs the money for their personal use; what alternative funding options are available from their private assets, etc..

Note that a FIFO (first in, first out) principle applies when distributing liquidation reserves. If you decide to distribute liquidation reserves that are less than five years old, those that are four years old must be distributed first. However, you may be able to distribute those reserves within a few months at (only) 5% withholding tax (once they have been retained within the company for five years).

Dividends on shares meeting the conditions of the VVPRbis regime were subject to the following withholding tax rates in the initial arrangement:

- 30% on distribution of profits for the financial year of incorporation (or capital increase) and for the following financial year;

- 20% on distribution of profits for the second financial year after the year of incorporation (or capital increase);

- 15% on distribution of profits for the third financial year after the year of incorporation (or capital increase) and for all subsequent financial years.

The Programme Act of 18 July 2025 abolished the 20% 'middle rate', but only for shares issued after 31 December 2025, leaving only the standard rate of 30% and the concessionary rate (currently 15%) for these shares.

Under the Budget Agreement struck on 24 November, this latter rate is set to rise from 15% to 18%. According to the latest reports, the rate increase was scheduled to come into effect on the first day of the month following publication of the new Act. All dividends paid after the Act comes into force would immediately be subject to the higher rate, regardless of when the reserves were accumulated.

It may therefore be tempting or even appropriate to pay out another dividend as soon as possible under the VVPRbis scheme, while the 15% withholding tax rate still applies.

However, when it comes to the (accelerated) payment of a dividend - apart from the rate increase - there are a number of other questions to consider.

- Is there a need to hold funds in private assets?

- How many years does the customer want to continue working through the company?

- Does the company qualify as a 'family firm' (which can be inherited at a flat rate of 3%)?

- Will the distribution affect the possibility to apply the reduced corporation tax rate?

We recommend expressing the potential rate benefit of an accelerated payment not only in percentage terms but also in cash terms, and weighing this benefit against any other potential consequences of a decision. Of course, the company will also have to follow the appropriate company law procedure (such as extraordinary or ordinary general meeting of shareholders, net asset test and/or liquidity test, etc.).

When a Belgian company receives dividends from another company, the dividend it receives can be exempted from Belgian corporation tax by applying the 'dividends received deduction' (DRD). For this tax deduction to be applied, three cumulative conditions must be met at the time the dividend is declared.

- The taxation condition means that the dividends received must relate to ‘good’ shares, i.e. shares held in companies that are subject to ‘normal’ (and therefore ‘final’) taxation on their profits in the country where they are established. If the company distributing the dividend pays little or no tax on its profits in the country in which it is established (for example a tax haven), the dividend received cannot be exempted.

- The holding period condition means that dividends received must relate to shares that are or were held in full ownership for a continuous period of at least one year.

- Finally, the company receiving the dividend must hold a participating interest in the distributing company of at least 10% of the capital or with an acquisition value of at least 2 500 000 euros. This is known as the ‘holding size condition’.

The Programme Act changes (tightens up) the holding size condition. if the company receiving the dividends holds less than 10% of the capital of the distributing company, the minimum acquisition value will be maintained at 2 500 000 euros. In other words, the increase to 4 000 000 euros as set out in the Coalition Agreement has not been retained. If the recipient of the dividends is a large company, from assessment year 2026 a participating interest (holding) of less than 10% will moreover have to take the form of a 'financial fixed asset' to be eligible for the dividends received deduction.

For the term 'financial fixed asset', reference is made to the meaning assigned to it in accounting legislation. This implies that the shares held should be included under 'participating interests in affiliated entities', 'participating interests in companies linked by participating interests' or 'participating interests in other financial fixed assets'. Disclosing the participating interest under these line items implies that the company intends to establish a lasting and specific connection with the company in which it invests and therefore does not see the participating interest purely as an investment.

Since the conditions applying for the dividends received deduction and the exemption from capital gains on shares in corporation tax are similar, there is an additional consequence for large companies. Capital gains on shares can only be exempted (for shareholdings of less than 10% and subject to some specific exceptions) if the acquisition value of the shares is at least 2.5 million euros and they are recorded as financial fixed assets.

This stricter holding size condition will apply with immediate effect from assessment year 2026! Changes made between 3 February 2025 and the closing date of the financial year will not be accepted unless it can be demonstrated that the change was motivated by economic (i.e. non-tax-related) considerations.

For small companies, the conditions applying for the dividends received deduction and capital gains exemption on shares will however not change. A company is deemed to be small if at the balance sheet date it does not exceed more than one of the following conditions:

- Annual average number of employees: 50

- Annual turnover, excluding value-added tax: 11 250 000 euros

- Balance sheet total: 6 000 000 euros

(Not) exceeding more than one of these thresholds will only have consequences if it occurs during two consecutive financial years.

Important note: when assessing the conditions, not only the data of the company itself but also of 'affiliated companies' must be taken into account.

A DRD Bevek is an investment company that has to meet a number of conditions. For example, a DRD Bevek must distribute at least 90% of the net income it receives.

A DRD Bevek offers a tax-efficient alternative to equity investments, as it allows the investor to benefit from exemption of dividends and capital gains on shares without having to meet the strict holding size condition and holding period condition (see above). However, the taxation condition must still be met for the DRD Bevek. A DRD Bevek can receive both qualifying and non-qualifying income. Qualifying income is income that meets the taxation condition. The ratio of qualifying income to total income (qualifying + non-qualifying) is calculated on an ongoing basis and produces the 'DRD coefficient'.

Specifically, the company investor can:

- Receive capital gains exemption on sale of shares of a DRD Bevek in proportion to the DRD coefficient. Under the Miscellaneous Provisions Act, exempt ‘capital gains’ realised on shares of DRD Beveks will in future be subject to 5% tax. In practice, however, the DRD Bevek will essentially always buy back (and immediately cancel) its own shares. In that case, the company-investor does not realise a capital gain on shares, but receives a redemption bonus (= dividend), to which it will be able to (permanently) apply the DRD deduction. The separate 5% assessment does not apply to this redemption bonus.

- Benefit from the DRD deduction on dividends distributed by the DRD Bevek in proportion to the DRD coefficient.

However, a DRD Bevek is required to deduct the appropriate withholding tax if it pays or declares a dividend. That is in contrast to a repurchase or liquidation bonus, which is not subject to withholding tax. In principle, the deducted withholding tax can be offset against corporation tax and reclaimed by the company-investor.

However, the Miscellaneous Provisions Act means that, from assessment year 2026, offsetting withholding tax against corporation tax will only be possible for dividends received from a DRD Bevek if the receiving company has paid the minimum remuneration for company managers in the income year in which it receives dividends from the DRD Bevek. Under the draft legislation, the minimum managerial remuneration would be raised to 50 000 euros (indexed).

You should not consider this news item an investment recommendation or advice.