Find your next car in KBC Mobile

Discover the wide range of new and second-hand cars with exclusive benefits

On the way to owning your dream car

Finding a car in KBC Mobile may sound surprising, but now you can do just that. Under MyMobility, you’ll find more than 800 new or second-hand cars with exclusive benefits, ranging from compact city cars to spacious family cars. Everything is set out conveniently in one place to save you hours of agonising searching.

Buying a car is not an everyday event, so you want to be sure that everything’s right for you. That’s why the only cars shown in KBC Mobile are those offered through reliable partners, such as accredited dealerships and leasing companies, ensuring you get quality and transparency.

When you’ve found your ideal car, contact the dealership directly through MyMobility and complete the sale there in a timely and efficient manner. Upload your purchase order, earn up to 250 Kate Coins * and you’re ready to hit the road!

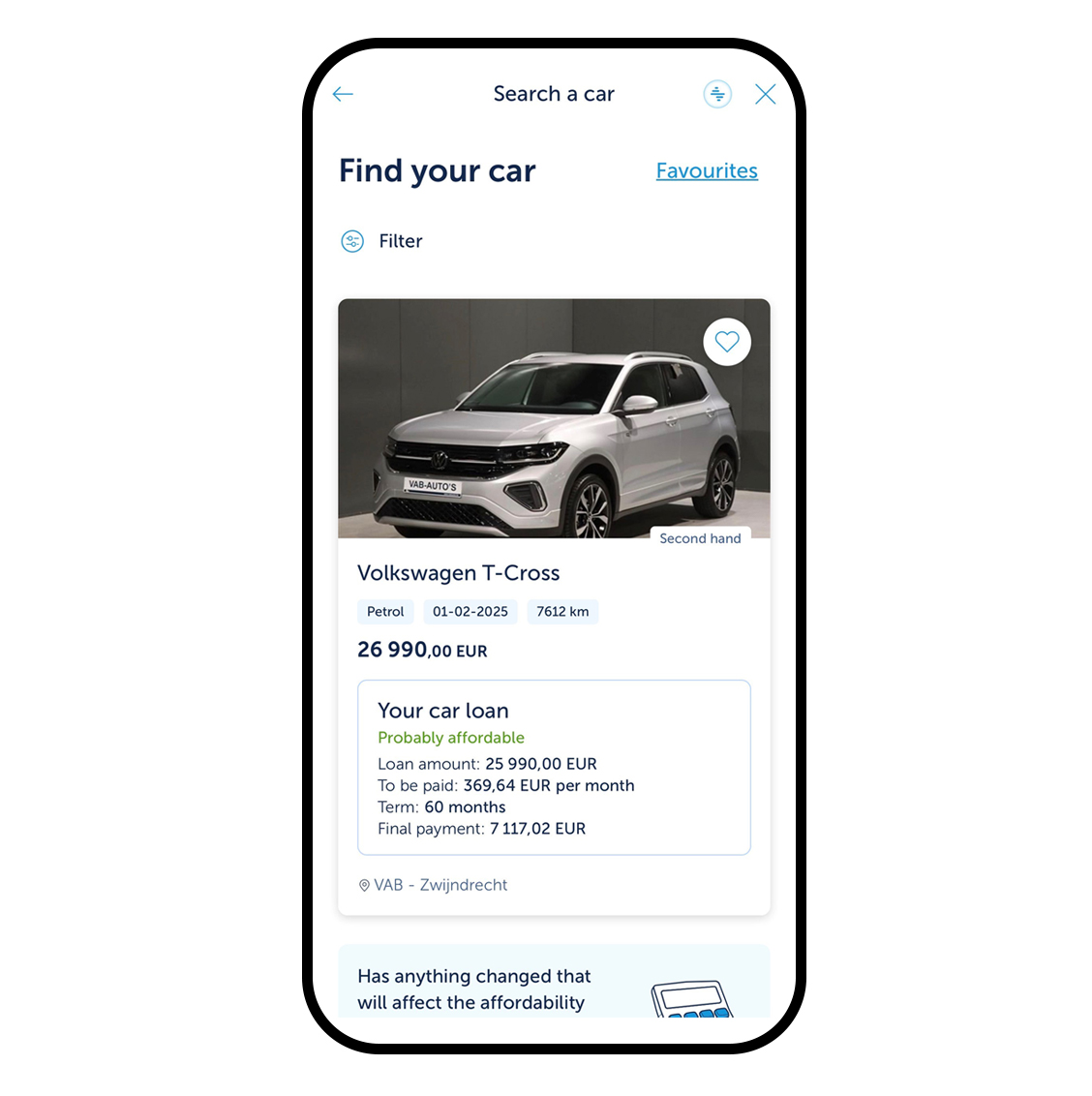

Make sure the car of your dreams is within budget

Imagine you’re scrolling through the cars on offer and you suddenly see one that ticks all your boxes. The question is, can you afford it? Thanks to the affordability check in MyMobility, you can easily see at a glance whether a car is within your budget.

For an idea of the overall price tag, you’ll also receive a no-obligation overview of how much a loan would cost, ensuring you stay fully informed before making your decision. Remember, borrowing money also costs money.

Take to the road with peace of mind

You don’t just want drive a nice car, you want to drive safely too. Enjoy peace of mind by taking out insurance. Whether you drive to work every day, take the kids to school or plan to go on a road trip, choose the car insurance that’s right for you so you can hit the road worry-free.

Want to learn more about mobility?

See all you can do with MyMobilityon our page and in our articles.

* The Kate Coin benefits programme is only available to KBC customers who have opted for ‘personalised’ commercial offers in KBC Mobile and hold a current account at KBC.

Loan type: Instalment loan. Subject to your loan application being approved by KBC Bank NV. Lender: KBC Bank NV, Havenlaan 2, 1080 Brussels, Belgium. VAT BE 0462.920.226, RLP Brussels.

Things you should know about KBC Car Insurance

KBC Car Insurance for Passenger Cars is a third-party liability insurance policy required by law. More information on this product can be found in the insurance information document, which we recommend you read carefully before taking out the product.

KBC Car Insurance may include one or more of the following types of insurance cover: Compulsory Third-Party Liability Insurance, Legal Assistance Insurance, Comprehensive All-Risk Insurance, Semi-Comprehensive Insurance, KBC-VAB Roadside Assistance Insurance and Driver Accident Insurance.

- This product is governed by the laws of Belgium.

- Insurance cover under this policy is valid for a term of one year and tacitly renews, unless it is terminated no later than three months before the main renewal date.

- Your intermediary is the first point of contact for any complaints you may have. If no agreement can be reached, you can contact KBC Complaints Management by post at Brusselsesteenweg 100, 3000 Leuven, by e-mail at complaints@kbc.be, by telephone on + 32 16 43 25 94 or + 32 78 15 20 45 (paid number), or by fax on + 32 16 86 30 38. If you cannot find a suitable solution, you can contact the Belgian insurance industry’s ombudsman service: Ombudsman van de Verzekeringen, de Meeûssquare 35, 1000 Brussels, info@ombudsman-insurance.be. This does not affect your legal rights.

Contact your Insurance Expert or visit our website to request a quote for KBC Car Insurance for Passenger Cars.

KBC Car Insurance is a product of KBC Insurance NV – Professor Roger Van Overstraetenplein 2 – 3000 Leuven – Belgium VAT BE 0403.552.563 – RLP Leuven – IBAN BE43 7300 0420 0601 – BIC KREDBEBB Company licensed by the National Bank of Belgium, de Berlaimontlaan 14, 1000 Brussels, Belgium, for all classes of insurance under code 0014 (Royal Decree of 4 July 1979; Belgian Official Gazette, 14 July 1979). Member of the KBC group.

* What is and isn’t covered under third-party liability insurance

Covered

Loss, damage or injury you cause with your vehicle to third parties, both material (e.g., exterior damage, damage to buildings, etc.) and physical (i.e. death or injuries). Injuries sustained by pedestrians, cyclists or passengers in traffic accidents in which your car is involved. Even if you are not liable, you can claim on this insurance.

Not covered

Some key exclusions are:

- Damage to your own vehicle

- Bodily injuries sustained by the driver in a traffic accident

- Damage caused during participation in competitions

- Damage you cause intentionally

The complete list of exclusions can be found in the General Conditions.

* What is and isn’t covered under semi-comprehensive insurance

Covered

- Damage caused by martens gnawing on your car’s cables and conduits

- Breakage of car window glass or sunroof glass

- Break-ins, theft and vandalism during theft

- Hail damage or damage caused by another force of nature (storm, lightning, flood, etc.)

- Damage caused by fire, explosion or fire-extinguishing activities (including damage caused by melting due to a short circuit)

- Damage caused by collisions with wild or stray animals

- Crashing aircraft or falling aircraft parts

- Any additional vehicle features which you can no longer use after your car has been declared a total loss (e.g., a set of winter tyres or a roof box)

Not covered

- Damage to your own car following an accident (for which you can take out our Fully Comprehensive Insurance)

- Your physical injuries as the driver, which you sustained in an accident (for which you can take out our Driver Accident Insurance)

- Theft you have facilitated by leaving your car unattended and unlocked on a public road

- Damage to parts caused as a result of wear and tear or by a lack of maintenance

- Damage you cause intentionally

The complete list of exclusions can be found in the General Conditions.

* What is and isn’t covered under fully comprehensive insurance

Covered

- Damage caused by a collision, fire, glass breakage, theft, vandalism, forces of nature, filling up with the wrong type of fuel, collisions with stray animals or birds, and gnawing martens

- The cost of replacing locks or reprogramming the locking system if your car keys are stolen

- Medical expenses if you’re injured during a car-jacking or home invasion

- Vehicle registration tax is covered free of charge if your vehicle is declared a total loss

- Damage to transported items

- We provide compensation of up to 1 500 euros for items you transport in your car which are intended for personal use if your car is also damaged, including bicycles on your bicycle rack or luggage in your roof box

- We also cover any additional vehicle features which you can no longer use after your car has been declared a total loss, such as your winter tyres or roof box

Not covered

- Damage you caused under the influence of alcohol (more than 0.15%) or in a similar condition due to the use of substances other than alcohol

- Damage you caused while driving your car in violation of the conditions laid down in Belgian laws and regulations

- Damage you cause intentionally

- Theft you have facilitated by leaving your vehicle unattended on a public road or unlocked in another location accessible to the public

- Your physical injuries as the driver of your vehicle (for which you can take out our Driver Accident Insurance)

The complete list of exclusions can be found in the General Conditions. Read the product information in full before taking out insurance.

Read this information carefully before taking out this insurance

Loan type: Instalment loan. Subject to your loan application being approved by KBC Bank NV. Lender: KBC Bank NV, Havenlaan 2, 1080 Brussels, Belgium. VAT BE 0462.920.226, RLP Brussels.