Time to choose a savings account!

These are the eligible savings products

KBC Savings Account in your child’s name

- Base rate of interest: 0.40%

- Fidelity bonus: 0.20%*

- You decide how you save and the amount

You can do this with individual credit transfers as well as an automatic savings order - If you want to withdraw money on a regular basis

Until your child's 18th birthday, you can withdraw their savings for free at any time, e.g. to buy a new bike (but the fidelity bonus only applies to money that remains in the account for 12 continuous months)

- If you would like your child to actively save their money

‘Saving for your dreams’ in KBC Mobile allows your child can set savings goals later on and easily track their progress towards each goal

This is a regulated ‘category A’ savings account, i.e. a traditional savings account without any additional conditions. You don’t pay any tax on interest up to a certain amount Read the key information for savers.

KBC Start2Save in your child’s name

- Base rate of interest: 0.75%

- Fidelity bonus: 1.50%*

- Standing order (max. 500 euros)

You choose a fixed amount to be transferred automatically each month

- If you prefer a higher yield

This savings account offers a higher fidelity bonus and base rate - If your child does not need the money immediately

To get the higher loyalty premium, you have to leave the money alone for a full year (but it remains available at all times)

This is a regulated ‘category B’ savings account, i.e. a savings account with a maximum monthly savings amount or a balance limit. You don’t pay any tax on interest up to a certain amount Read the key information for savers.

*The fidelity bonus applies only to amounts that remain in the account for 12 continuous months.

Additional information about the return for your child

The rates shown are gross (expressed on an annual basis) and may change at any time. The current rates are always given here or can be obtained from your KBC branch. If rates change, we will of course inform you online or by e-mail.

Your savings earn the base rate of interest starting from the day after your first transfer. Your money stops earning interest as soon as you withdraw it. This interest is paid into your account once a year: 1 January or when you close your account.

You receive the fidelity bonus on money that remains in your savings account throughout the calculation period of one full year. When funds are withdrawn, the accruing fidelity bonuses whose acquisition date is furthest in the future will be the first to be used. For the first three transfers of funds per year to another regulated savings account at KBC, however, the fidelity bonus will be transferred proportionally if the following conditions are met:

- Both accounts have at least one account holder in common

- The amount transferred is at least 500 euros

- The funds are not transferred by standing order or automatic savings order

In this scenario, the one-year calculation period is not interrupted, but instead continues on the other savings account. Even then, the fidelity bonus is only paid for amounts that remain on the KBC savings account for one year.

A new calculation period of one year always begins once you have received your fidelity bonus. The fidelity bonus rate is the interest rate prevailing on the first day of a new calculation period. That rate is fixed and remains unchanged for the entire calculation period, except when the fidelity bonus is transferred proportionally. In that case, the fidelity bonus for the remaining period is the interest rate prevailing on the day the funds go into the receiving savings account.

At the beginning of each new quarter (on 1 January, 1 April, 1 July and 1 October), the fidelity bonus you earned during the previous quarter will be paid into your account. Your vested fidelity bonus will also be paid to you if you close your account.

Features and risks of eligible savings products

The KBC Savings Account in your child's name and the KBC Start2Save in your child's name are regulated savings accounts at KBC Bank NV Belgium. It is governed by the laws of Belgium.

- Free of charge

There are no charges for opening and managing this savings account for children. Receiving printed account statements by post however, costs you 2.50 euros a month if they are sent monthly or 25 euros a month if sent daily. - Tax efficient

Individuals who are resident in Belgium are exempt from 15% withholding tax on the first 1,020 euros of interest earned each year (2026 income). - Access your money at any time

The KBC Savings Account in your child's name and the KBC Start2Save in your child's name are open-ended products. Your savings can be withdrawn at any time and without charge. As a statutory representative, you may only withdraw or transfer funds when it is in the best interests of the minor. - Keep an eye on things

As a parent, you can track your child’s finances in KBC Mobile or KBC Touch until they turn 18. You can also rest easy knowing that your child is only allowed to withdraw a small amount each month (up to 125 euros) once they turn 16. - Automatic savings orders

A KBC Savings Account in your child's name allows you to set up an automatic order as well as make individual transfers. Saving with a KBC Start2Save in your child's name is only possible by means of a monthly standing order to transfer funds (up to 500 euros euros) from a current account at KBC or another financial institution. You can only set up one order per KBC Start2Save in your child's name.

- Insolvency risk

Your deposits at KBC Bank are guaranteed up to 100 000 euros per person, subject to certain conditions. In the event of KBC’s insolvency (e.g., if it goes into bankruptcy), you run the risk of losing any deposits you have over 100 000 euros, or their amount may be reduced or converted into shares (e.g. if you have 110 000 euros in savings, you could potentially lose 10 000 euros). You can obtain a free copy of our ‘Protection of deposits and financial instruments in Belgium’ brochure from your KBC branch or from www.kbc.be/depositprotection. - Inflation risk

Sustained price increases may result in your saved money losing value.

Further information and complaints

Be sure to read the documents with key information for savers before opening one of the eligible savings accounts for your child. If you have a complaint, please contact KBC Complaints Management: (tel. + 32 16 43 25 94 / complaints@kbc.be). If the matter fails to be resolved through this channel, you can turn to the Ombudsman in financial conflicts (www.ombudsfin.be).

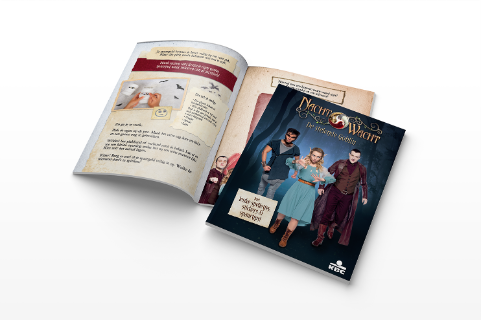

Chosen a savings account for your child?

Open one (or more) of the eligible savings accounts and get the fun Nachtwacht activity book as a gift. But don't wait too long, these books are popular and stocks are limited!