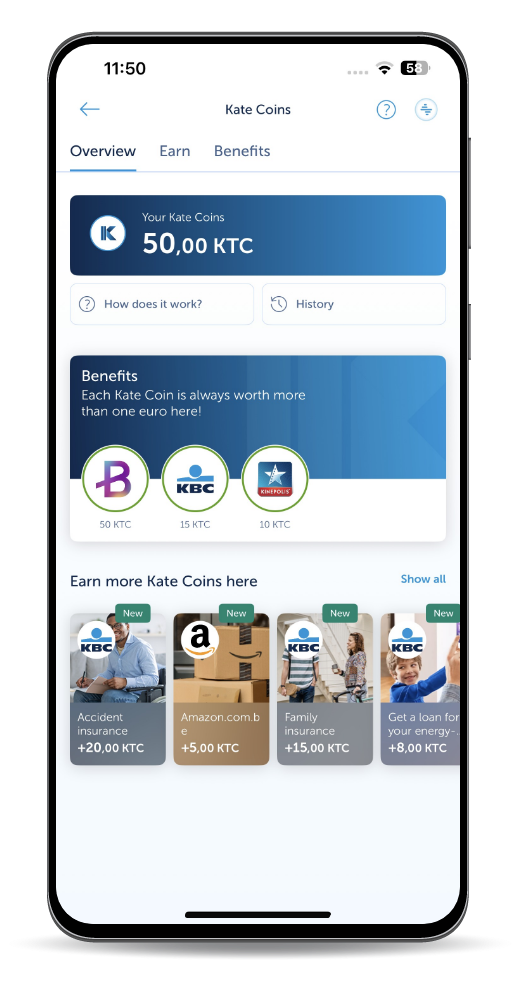

You can do more with Kate Coins

You can use them to shop and enjoy great food, but also to laugh, get your roof fixed or pay your broker’s fee.

Whatever you choose to do with them, one thing is certain: you can do more with Kate Coins.

Step 1: Earn

You can earn Kate Coins in all sorts of ways: not just from KBC, but from our partners as well.

Step 2: Use

You can now decide what you want to spend your Kate Coins on.

- If you spend your Kate Coins at KBC and our partners, they are always worth more than one euro each

- Some partners offer a cashback on your account in exchange for your Kate Coins. For other partners, you exchange your Kate Coins for a voucher that you can use afterwards

- You can also save them for later – the benefits available change regularly and there are always great new deals to be discovered

- If you didn't use your Kate Coins during the year, they will be automatically converted to euros and deposited in your account at a rate of one euro per Kate Coin unless you indicate that you would prefer to keep them

Use your Kate Coins and choose your benefit

Earn your Kate Coins

You might not see all these partners in your KBC Mobile app. The offer can be different and will be tailored to your personal situation. In addition, the options available change regularly as we’re always looking for new partners with great benefits. So be sure to keep an eye on your app to see what’s new!

Opt for ‘Personalised’ to receive Kate Coins from our partners

The Kate Coins benefits programme is only available to KBC customers who have opted for ‘personalised’ commercial offers in KBC Mobile and hold a current account at KBC.

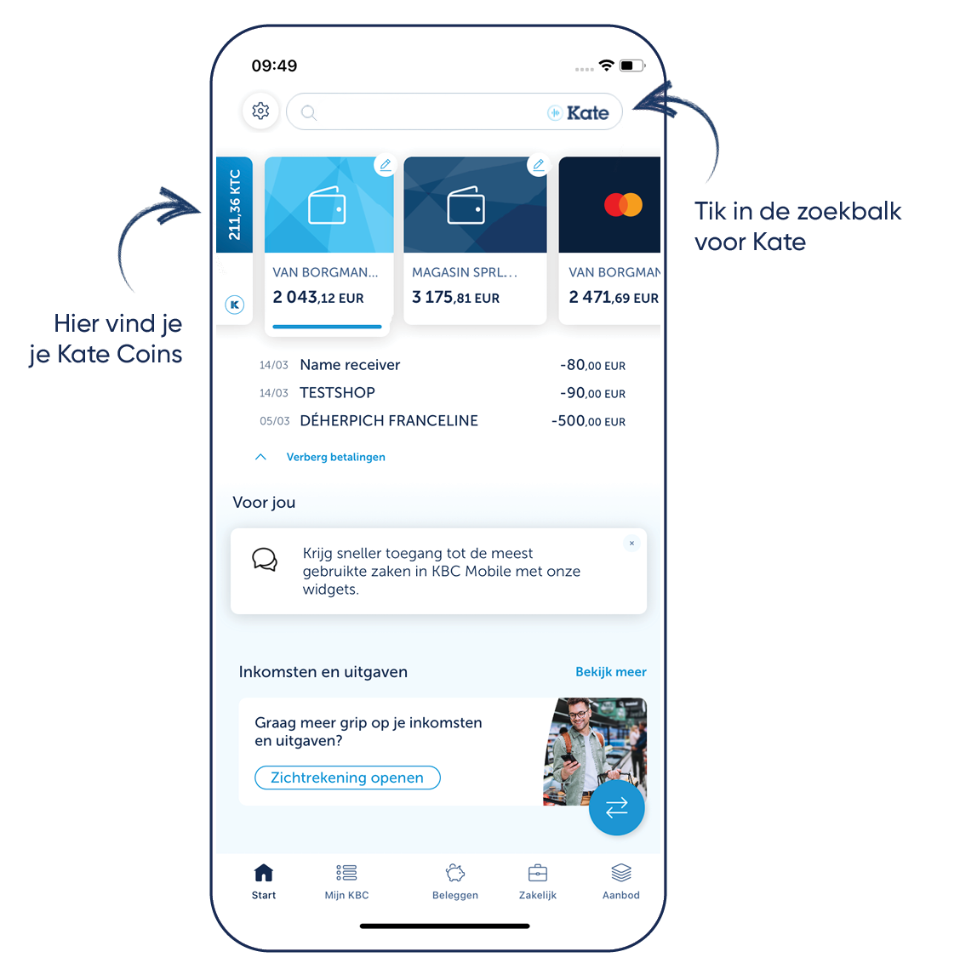

Where can you find Kate and Kate Coins?

- Just tell Kate: ‘Show my Kate Coins’.

- Kate will show you an overview of all your options. You can learn more about what Kate Coins are, see your balance, and find out how to receive and use your Kate Coins.

- Or tap the tile on the far left in your KBC Mobile.

Good to know about KBC Home Assistance

Belgian law applies to this product.

Your intermediary is your first point of contact for complaints. If agreement cannot be reached, please contact KBC Complaints Management: Brusselsesteenweg 100, 3000 Leuven – E-mail: complaints@kbc.be – Tel.: tel. 016 43 25 94 (free of charge) or + 32 78 15 20 45 (charges apply) – Fax: + 32 16 86 30 38. If you cannot find a suitable solution, you can contact the Belgian insurance industry's ombudsman service: Ombudsman van de Verzekeringen, de Meeûssquare 35, 1000 Brussels – E-mail: info@ombudsman.as – Website: www.ombudsman.as.

This does not affect your right to take legal action.

Contact your insurance expert to request a quotation for KBC Home Assistance or use KBC Mobile.

KBC Home Assistance is a product of KBC Insurance NV – Professor Roger Van Overstraetenplein 2 – 3000 Leuven – Belgium

VAT No. BE 0403.552.563 – RLP Leuven – IBAN BE43 7300 0420 0601 – BIC KREDBEBB

Company authorised for all classes of insurance under code 0014 (Royal Decree of 4 July 1979; Belgian Official Gazette, 14 July 1979) by the National Bank of Belgium, de Berlaimontlaan 14, 1000 Brussels, Belgium.

Member of the KBC Group

Read this information carefully before taking out this insurance

What is insured?

When do we provide assistance?

- You have an electricity outage

- Your heating or air conditioning stops working and the interior temperature becomes unpleasant

- You have no running water in your home or no hot water in your bathroom

- Your toilet's blocked (other than due to the septic tank being full)

- Wasps or bees have nested on or in your home

- You can't leave or enter your home because the entrance is barred or blocked, because your keys have been stolen or lost or because you've locked yourself out

- Your home is no longer wind and watertight, for instance because the roof or a window is damaged

When do we not provide assistance?

- Due to circumstances for which you are responsible, the person providing assistance cannot get into your home at the appointed time

- The problem for which you request assistance is your own responsibility because you failed to repair a known defect or did not have full repairs done after a previous intervention

- The problem is due to deliberate acts or omissions by an occupant or poor maintenance or material decay of your home

- The network supplier interrupts or cuts off the gas, electricity or water supply

- There is damage to domestic appliances like a fridge, oven, extractor hood, cooker or portable radiator

- Poor or non-working of an integrated switch, electronic circuit, microchip, microprocessor, hardware, software, computer, alarm or domestic electronic equipment, telecommunications equipment or similar electronic systems

Good to know about KBC Family Insurance

- This product is governed by the laws of Belgium.

Insurance cover under this policy is valid for a term of one year and is tacitly renewed unless you cancel it no later than three months before the main renewal date.

For policies taken out or tacitly renewed on or after 1 October 2024, you have up to two months before the main renewal date to cancel them. As from the second insurance year, you can cancel your insurance at any time, with effect after two months have elapsed from the day after the registered letter was submitted for delivery, the writ was served or the date of the acknowledgement of receipt.- Your intermediary is the first point of contact for any complaints you may have. If no agreement can be reached, please contact KBC Complaints Management, Brusselsesteenweg 100, 3000 Leuven, complaints@kbc.be, tel. 016 43 25 94. If you cannot find a suitable solution, you can contact the Belgian insurance industry's ombudsman service: Ombudsman van de Verzekeringen, de Meeûssquare 35, 1000 Brussels, info@ombudsman-insurance.be, www.ombudsman-insurance.be.

- This does not affect your legal rights.

To request a premium calculation for KBC Family Insurance, visit www.kbc.be, use KBC Touch or KBC Mobile, or contact your Insurance Expert.

KBC Family Insurance is a product provided by KBC Insurance NV – Professor Roger Van Overstraetenplein 2 – 3000 Leuven – Belgium.

VAT BE 0403.552.563 – RLP Leuven – IBAN BE43 7300 0420 0601 – BIC KREDBEBB

Company licensed by the National Bank of Belgium, de Berlaimontlaan 14, 1000 Brussels, Belgium, for all classes of insurance under code 0014 (Royal Decree of 4 July 1979, Belgian Official Gazette of 14 July 1979).

Member of the KBC group

Read this information carefully before taking out this insurance

What is and isn’t covered?

Covered

- Loss, damage or injury caused to other individuals

We will compensate the person who suffered the loss, damage or injury. This applies, among others, to

- any loss, damage or injury caused by your animals to other individuals

- damage to entrusted goods

- Loss, damage or injury caused by the actions of another person

If you take out personal legal assistance insurance, we’ll help you get compensation from the liable party. If they are unable to pay, we’ll pay up to 12 500 euros in compensation. This figure is doubled in the case of bodily injuries.

Not covered

- Loss, damage or injury which you cause to yourself or family members

- Loss, damage or injury resulting from gross negligence on the part of a member of your family aged 18 or older

- Loss, damage or injury caused intentionally by a member of your family aged 16 or older

- Loss, damage or injury caused by your riding horses or by animals that you, as a private individual residing in Belgium, are not allowed to keep

- Fines and out-of-court settlements

- Disputes in which you are involved as the owner or driver of a motor vehicle that is subject to compulsory motor insurance

Compensation and deductible

- For bodily injuries, we provide cover of up to 30 million euros per claim event and there's no deductible to pay.

- We provide cover of up to 10 million euros for material damage (with a compensation limit of 15.000 euros for damage to entrusted goods) and you pay a deductible of 250 euros per claim event.