Save time and earn money

with Kate and Kate Coin

Kate en Kate Coin make your life easy

Ah, life. There’s always so much to do and so little time, with all sorts of expenses to pay for and things to think about. Sometimes it just flies by!

That's why at KBC we believe in moving forward together. Thanks to Kate in KBC Mobile, you can deal with all kinds of tasks in a fraction of the time. And that’s not all, Kate Coins allow you to earn money at KBC and our partners. It doesn’t get much better than that! Discover how to save time and earn money in KBC Mobile!

Kate is your digital assistant in KBC Mobile and is always on hand to help make your life just that little bit easier.

- No more thick wallets stuffed with loyalty cards. Save your cards in KBC Mobile and find them instantly with the help of Kate.

- You can also buy your train ticket hassle-free with Kate in KBC Mobile, so perhaps you won’t miss your train after all!

- Forgetting your PIN is always annoying, especially when you’re standing at the till on a busy Saturday with a long queue waiting behind you. Just tell Kate: ‘Forgot my PIN’ to get help right away. Never be embarrassed again!

- Suffered damage? You’ll want to get it fixed as soon as possible. File your claim quickly with Kate in KBC Mobile.

- Kate is on hand to help even when you’re on holiday. Ask Kate to activate your bank card for use abroad and you’re all set, bon voyage!

- Thanks to your Kate Coins in KBC Mobile, you can get tidy cashback rewards at KBC or our partners. There are always new offers appearing in KBC Mobile.

- If you’re looking for your Kate Coins, just ask Kate!

Opt for ‘Personalised’ to receive Kate Coins

If you’ve opted for ‘Personalised’ commercial

offers in KBC Mobile, great! That means you can receive and earn Kate Coins. Kate Coins are part of the ‘Personalised’ service for indicating how you want to receive commercial

offers.

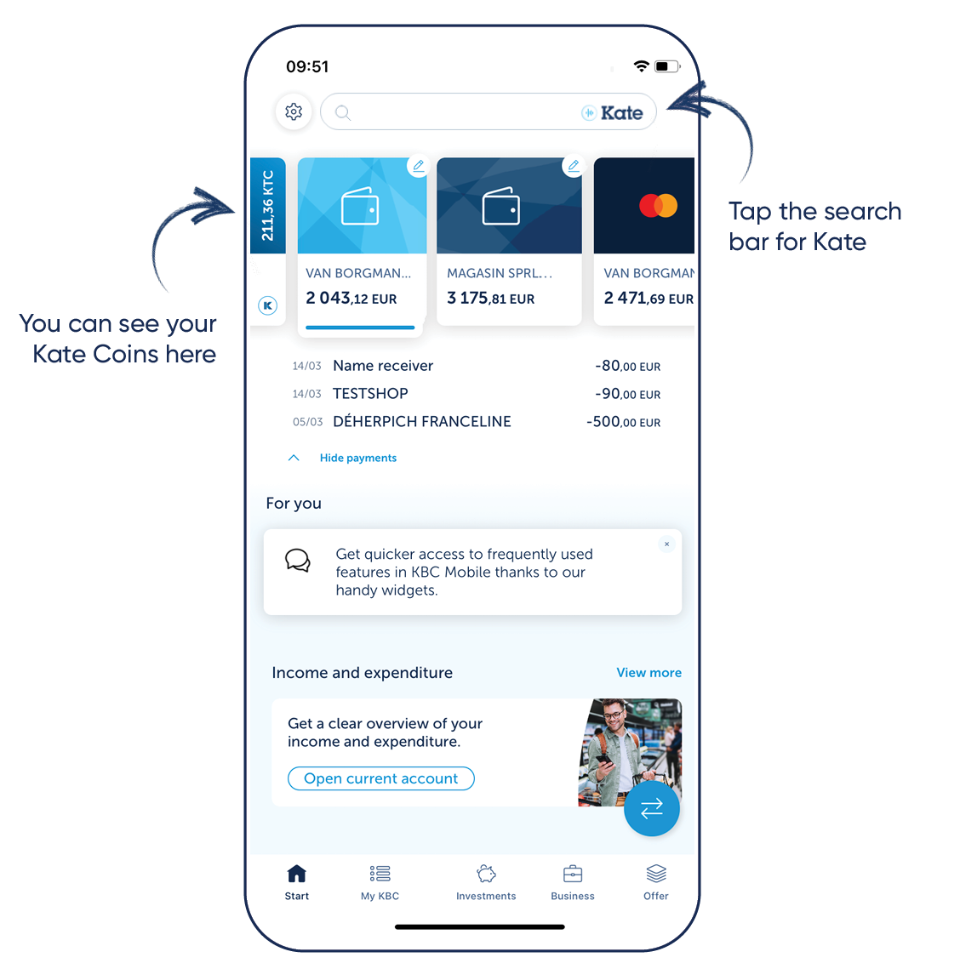

Where can you find Kate and Kate Coins?

- You can find your digital assistant at the top of the screen in KBC Mobile. Just tap the search bar at the top to get started.

- Just ask Kate to ‘Show my Kate Coins’.

- Kate will show you an overview of all your options. You can learn more about what Kate Coins are, see your balance, and find out how to receive and use your Kate Coins.

.png)

.png/_jcr_content/renditions/cq5dam.web.960.9999.png.cdn.res/last-modified/1756214108844/cq5dam.web.960.9999.png)