Conditions

With effect from the income year 2018, investors who meet certain conditions may reclaim the withholding tax they have paid on dividends received. These conditions are explained below.

This tax advantage only applies for natural persons (residents or non-residents of Belgium); it does not apply for legal entities. The exemption applies for each taxpayer. Each partner in a married couple may receive this tax advantage (the ‘exemption basket’).

Dividends received on both Belgian and international shares are eligible. By ‘dividends’, we mean “all benefits awarded by a company on shares or profit-sharing certificates, howsoever they are named, in whatever capacity and in whatever manner they are obtained”. Not all dividends are eligible. The law expressly excludes the following:

- dividends distributed by or through the agency of legal constructions (entities subject to the ‘Cayman tax’);

- dividends paid by undertakings for collective investment in transferable securities (‘funds’) or distributed through the agency of mutual funds;

- dividends originating from special distribution transactions (e.g. merger transactions, distributions from the capital of the company or purchase of treasury shares);

- reclassified interest (i.e. interest which the company assigns to its shareholder/director and which exceeds certain limits).

The former withholding tax exemption for dividends paid by recognised cooperative companies or companies with a social object has been scrapped and integrated in the new exemption basket. As a result, dividends paid by recognised cooperative companies (such as Cera or BRS) will henceforth also be subject to withholding tax at source.

Moreover, the new rules apply only for dividends awarded or paid in respect of the year 2019.

For the income year 2025 (assessment year 2026) you can reclaim withholding tax up to 249.90 euros. That is equivalent to dividends totalling 833 euros (assuming they are subject to the withholding tax rate of 30%).

If you have received dividends to which different rates of withholding tax apply, you can decide for which dividends you wish to apply for this exemption.

As the exemption does not apply at source, you must in principle always pay withholding tax when you receive the dividends. You can reclaim the withholding tax deducted by entering it on your personal income tax return. The withholding tax deducted will be set off against the income tax you have to pay. If you do not pay personal income tax, the deducted amount will be refunded.

Specifically, you should declare the withholding tax deducted under codes 1437 and 2437 in your personal income tax return for assessment year 2021. However, you are not required to declare the dividend amount actually received in your tax return.

Non-residents can reclaim the withholding tax deducted via the income tax return for non-residents.

If you are a non-resident and do not have to submit an income tax return in Belgium, you can submit a written application for reclaiming the withholding tax to the 'Adviseur-generaal van het Centrum Buitenland'/Conseiller général du Centre Étrangers' at the Federal Public Service - Finance.

- As part of the application, you should enter your details via which the tax authorities will be able to identify and contact you.

- You will also need to enclose a certificate of non-resident status.

- In addition, you must enclose evidentiary documents which demonstrate that you are entitled to reclaim the withholding tax deducted (see the types of evidence under the next question).

Your application must be submitted no later than 31 December of the year following the calendar year in which you received the dividends. Note, however, that your application only applies to the withholding tax that is effectively due after taking account of the rate reduction allowed under a double tax treaty.

If the rate reduction under a double tax treaty has not been applied or has been applied only in part, you should file an appeal with the tax authorities.

The Royal Decree of 28 April 2019 states that you must keep the documents that demonstrate the following at the disposal of the tax authorities:

- the company which paid out the dividend;

- the gross amount of the dividends for which exemption is being claimed;

- the country of origin of the dividend and the amount of the foreign tax paid (for dividends of foreign origin received by Belgian residents);

- the withholding tax rate applied;

- how much withholding tax was withheld;

- the date on which the dividend was paid or declared by the company (for dividends of Belgian origin);

- that the dividend was effectively received and when.

You do not have to enclose the documents with your income tax return, but you must be able to present them in the event of an inspection by the tax authorities.

Matrimonial property law applies. If you’re taxed together as spouses, you must declare income from your capital and movable assets as follows:

- Income forming part of a spouse’s personal assets under property law must be declared in full in the spouse’s name

- Half of all other income must be declared in the name of each of the spouses

The same principle applies to any withholding tax deducted.

It doesn’t matter whether the dividends are paid to an account in the name of both or just one of the spouses.

Investment income of minors is added to the income of their parents. Minors are therefore not entitled to this tax advantage in their own right. If minors have received dividends, the withholding tax deducted from those dividends must be reclaimed on their parents’ personal income tax return.

If you receive dividends on foreign shares directly in a country other than Belgium, the withholding tax will not be deducted at source. You must therefore enter this investment income on your tax return. This means you will have to pay personal income tax on those dividends at a rate that is equal to the withholding tax rate.

You should also no longer enter those dividends on your annual tax return. N.B.: Only the first tranche of dividends, up to 800 euros, are exempt. If you receive a higher amount in dividends in another country which are not eligible for this new exemption basket, you must of course include them on your tax return.

In the event of a legacy or gift subject to usufruct, the bare ownership of the shares in principle belongs to the children and the usufruct to the parent(s). In principle, the usufructuary will receive the dividends and therefore have to pay the withholding tax. In that case, the usufructuary includes the dividends in his or her exemption basket.

A dividend payment need not necessarily be in the form of cash. We then speak of a dividend ‘in kind’. The same conditions apply for these dividends, which means they are eligible for the exemption basket.

In the case of entities with joint ownership of property (e.g. a civil company or an entity with joint ownership of property established through a gift or legacy), the withholding tax on dividends is in principle paid at source. The members of an entity with joint ownership of property can each reclaim their portion of the deducted withholding tax. See the conditions above for more details on this. The proportionate entitlement of each member is described in the articles of the company, a deed of gift or a statement of inheritance.

Specifically, you should declare the withholding tax deducted under codes 1437 and 2437 in your personal income tax return for assessment year 2021. However, you are not required to declare the dividend amount actually received in your tax return.

In that case, you will receive a separate certificate for this.

Don’t forget to include them in your calculation. You can add dividends together until your exemption basket of 800 euros per person is full.

Information of dividends from KBC and for your Bolero account

For the assessment year 2026 (dividends received in respect of 2025), KBC and Bolero will not send you a personal statement.

You will find information on dividends from KBC Bank on your bank statements in KBC Touch and in KBC Mobile.

On your bank statements

You will find information on the dividends in the appendix to the statement of your dividends.

In KBC Mobile

Select the account into which the dividend was paid. Tap ‘Completed transactions’ using the search term 'dividend'. Only look at statements for the period from 01-01-2025 to 31-12-2025. If you select an individual statement, you will find the dividend information in the appendix.

In KBC Touch

Select the account into which the dividend was paid. Tap 'Search and download report’ using the search term 'dividend'. Only look at statements for the period from 01-01-2025 to 31-12-2025. If you select an individual statement, you will find the dividend information in the appendix.

Dividend information for your Bolero account

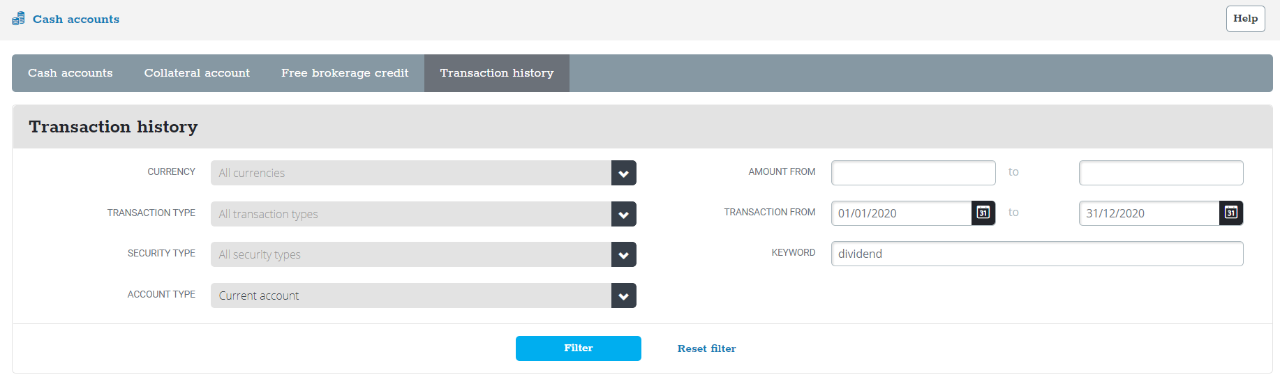

You will find the dividend information for your Bolero account on the Bolero platform.

Go to the menu ‘Accounts’ – ‘Transaction history’ and use the search term ‘dividend’. Select the transactions for the period 01-01-2025 to 31-12-2025. If you click on the information button (i-button), you will see the details and the amount of withholding tax.

Please note! This will show you all dividends, but you cannot reclaim the withholding tax for all dividends. You will find more information on this in the FAQs above.