Mortgage loan

- Always get your best rate at KBC (online and in-branch)

- Discount on your interest rate for an energy-efficient home

- Time to go through your application with an expert before deciding

See if your loan is feasible by answering a few questions and uploading the necessary documents. Your home expert will then contact you to go through everything before you submit your home loan application.

Why go for a mortgage loan from KBC?

Find out more about the mortgage loan

You can immediately check online to see if your loan is feasible. If you like what’s being offered, we’ll help you fill in your application. You’ll then have all the information you need to decide if you want to apply for the loan.

In practice, your application comprises 3 steps:

1) Work out your loan

We first need you to provide us with some more information, including details of your project, as well as certain personal details, including your income and the loans you currently have. You can then find out right away whether your loan is feasible or not and see a detailed calculation of the monthly costs. You no longer have to negotiate your interest rate either, as you always automatically get the best rate at KBC. It couldn’t be easier!

2) Check to see if you can apply for your loan

You can then immediately check online to see if you are in a position to apply for your loan with KBC. If you get the green light and want to proceed with your application, indicate that our home expert may call you to schedule a phone appointment.

3) Submit your loan application

During the phone call appointment, you and the home expert go through your application, ensuring you have filled in everything correctly. After doing that, you still have time to decide whether or not to apply for the loan.

If you want to work out or apply for a home loan, make sure you have the following documents to hand or bring them with you:

- The signed purchase agreement for your new home (provisional sales contract) or the title deed for the building plot or the property to be renovated.

- The building plans, specifications or quotes for the property you are building or renovating.

- Building permit if you need one for the works and it is already available.

- A copy of your current loan contract and attendant repayment schedule if you want to refinance a home loan with a lender other than KBC.

- Recent pay slips if you are a salaried employee.

- If you’re self-employed or engage in a liberal profession, an overview containing the latest operating figures for your business plus the income tax return, if available, for the same year as the operating figures provided.

- If applicable, a recent account statement proving you receive replacement income or other forms of income, such as rent and alimony.

- A recent account statement for your savings, a list of your investments and any third-party financial aid that you will invest in your project.

- The energy performance certificate (EPC) for the property you want to take out a loan for. If you’re offering another property as collateral, you also need to provide the EPC for that property.

Got plans to build or want to buy or build a house or apartment? With a mortgage loan for immovable property, you can borrow a share of the money you’ll need. This loan is mostly covered by a mortgage and/or a power of attorney to create a mortgage.

You can apply to KBC for a mortgage loan only if you live in Belgium and receive your principal income in euros.

The amount you can borrow depends on three factors

- How much you can pay back

A good rule of thumb: the total of your monthly credit obligations may not be higher than 40% of the monthly net household income. - The cost of your home and the amount that you’ve already saved

You can never borrow more than the total cost of your home. KBC also expects you to finance part of the project with your own funds. - The guarantees that you can give the bank

KBC requests collateral to cover themselves against the risk that you no longer repay your loan. A mortgage is usually established on the property, giving the bank the right to sell it if you can no longer meet your credit obligations.

There is no ideal term. For a mortgage loan, the average term is between 10 and 25 years. But how do you go about choosing the most convenient term for you? We recommend deciding the term based on a number of criteria.

- Your age

The most suitable term depends on your age. For instance, you might choose a term of 15 years because your children will be moving into student digs by the time the loan is paid off and you want to be free of repayments at that stage. - Your income

Aim to keep the total of your monthly repayments below 40% of your monthly net household income. - Your repayment method

Each repayment is comprised of principal and interest. The proportion of each depends on the selected method of repayment. The most popular repayment method involves equal monthly repayments. - Your interest rate

The term of the loan also depends on whether you choose a fixed or a variable interest rate.

When you take out a mortgage loan, you can choose between two different credit options: a fixed or a variable interest rate. Which interest rate is more attractive for your situation?

Use our loan calculator to work out the interest rate of your loan

When you take out a mortgage loan, you can pay interest at either a fixed or variable rate.

In the case of a fixed rate of interest, the interest rate is set at the start of your home loan. That rate stays the same, regardless of movements in long-term interest rates, and your monthly payments are fixed for the entire term of the loan.

In the case of a variable rate of interest, the interest rate on your home loan is reviewed after a certain period of time. At the time the interest rate is reviewed, you can choose to shorten, maintain or extend the term of your home loan at no cost.

This is referred to as your accordion option and enables you to tailor your monthly home loan payments to take account of your personal situation.

If you’ve taken out home insurance and/or loan balance insurance at KBC and your salary is paid into an account there, you’ll receive one or more contingent discounts on your KBC Home Loan. We can also offer you an even lower rate if your down payment is high enough.

If you buy an energy-efficient home, you can get an additional discount on the interest rate for your new mortgage loan right away. You can also make improvements to your home’s energy efficiency within seven years, which will net you a discount on your interest rate when you submit your new (improved) EPC rating.

You can now get answers to your questions without leaving the comfort of your home using one of our convenient online options. Find out how.

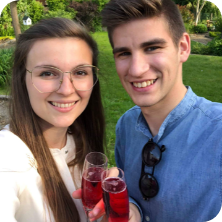

It’s brilliant being able to find out in KBC Mobile whether we could afford the loan for our dream home. All we needed to do was answer a few questions and a list of available options popped up. We still had some questions, so we contacted the KBC Live experts and they were more than happy to help.

Evi and Gert-Jan from Halle

Good to know

Lender: KBC Bank NV, with registered office at Havenlaan 2, 1080 Brussels, Belgium. VAT BE 0462.920.226, RLP Brussels, FSMA 026 256 A. Subject to your loan application being approved by KBC Bank NV.

KBC Bank NV does not offer loan agreements in foreign currencies. By law, these sorts of loan agreements are defined as loan agreements under which the credit:

- is expressed in another currency than that in which the consumer receives the income or holds the assets out of which the loan is to be repaid;

or

- is expressed in another currency than that of the member state where the consumer resides.

KBC Bank therefore concentrates exclusively on individuals who live in Belgium and whose main income is in euros.