Want to teach your teenager to manage money?

If it’s (almost) time for your child to attend secondary school, you know they’ll be starting a new chapter in life, one with more independence, more of their own choices... and more responsibility as a result. A personal account is the logical next step. It’s not only easy to use, it’s also a powerful tool for learning.

Why should your teenager have their own account?

1. A milestone in financial independence

With their own account, debit card and banking app, your teenager will learn to handle money in the real world. They can see money going in and out in real time, learn how to plan, make choices and set priorities. While this is going on, however, you get to keep a parental eye on things.

2. Bring pocket money into the digital age

It’s easy for cash pocket money to get lost or forgotten, and the last thing you want is to end up as a last-minute ATM! If your teenager has their own account:

- you can easily set up a standing order to transfer pocket money (one less thing to worry about!)

- your child will always have a way to make payments when they’re out and about alone or with friends, whether that’s using a card, a banking app, or apps like Apple Pay.

- your child can check their balance at any time

Don’t want your child to withdraw or spend too much pocket money?

You can easily set limits with the ‘Parental supervision’ dashboard in KBC Mobile or Touch.

3. Gifting money is simple using your teenager's account number

Teenagers often get money for their birthdays or at Christmas. If your teenager has their own account:

- friends and family can transfer gifts of money to your teenager's account (so much easier than envelopes of cash!)

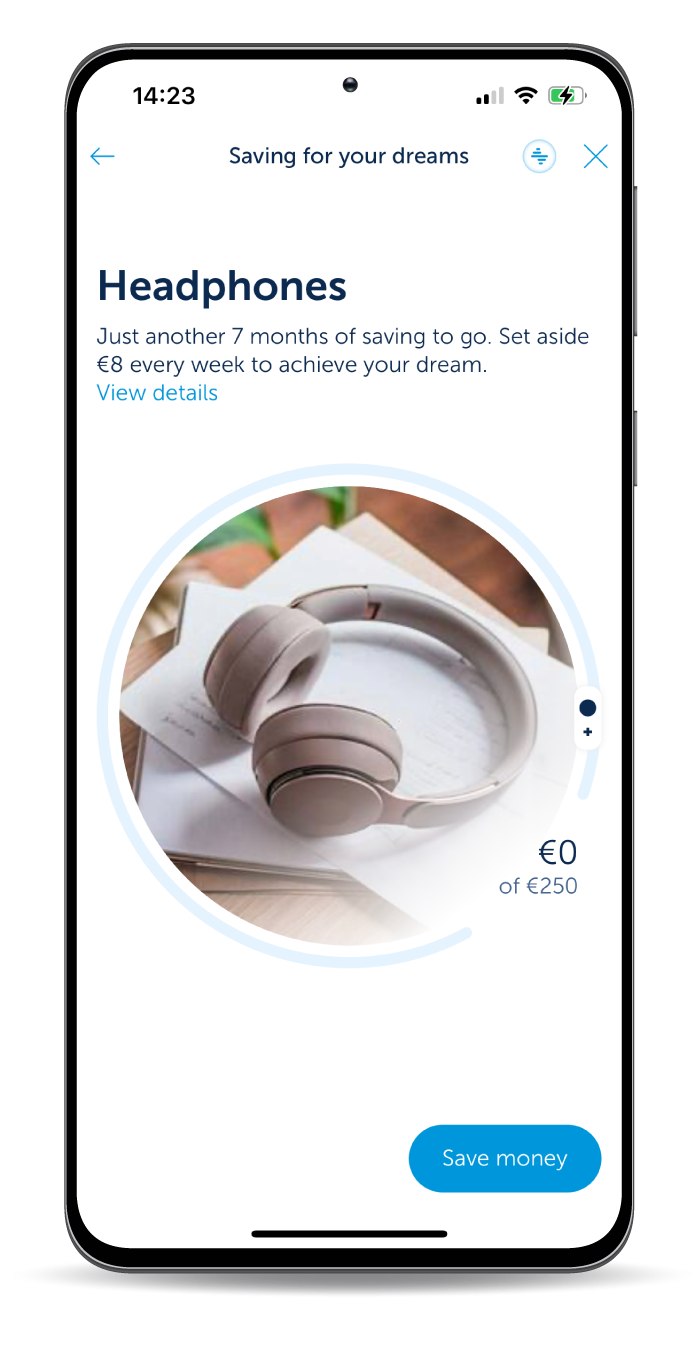

- they can save up for bigger purchases (the Savings goals feature in KBC Mobile makes it easy and fun!)

- money transfers can come gift-wrapped thanks to Surprise Pay

4. A first job means a first pay packet!

Once they turn 16, your teenager can pick up a student job to earn a little extra. That’s when it’s essential to have a personal account:

- wages are paid directly into the account

- your little trooper will get a push notification in KBC Mobile each time money is credited to their account – always good news!

- you can set up a standing order together to set aside some of their salary each month – a smart way to prevent those hard-earned pennies from being frittered away

5. Learning to budget together

An account isn’t the finish line, but the first step. For example, you may want to plan a monthly budget check-in with your teenager. In KBC Mobile, you can both see:

- a graph that clearly shows how much money is coming in and going out

- how much they’ve spent on snacks, clothes, etc.

- smart insights, such as ‘You spent more on food and drink this month’

This gives you the ability to adjust spending patterns by setting stricter rules (e.g., reducing daily limits) or giving more freedom (e.g., allowing online payments). And it gradually teaches your teenager the right way to go about handling their finances.

Ready for the first step?

A young person’s account is free of charge for 10- to 24-year-olds and easy to open. With their own debit card and the best banking app in the world2, your secondary school student has all the tools they need to become financially independent.

1 11-year-olds are applying for twice as many bank cards before starting secondary school | Spaargids

2 Independent research agency Sia has crowned KBC Mobile the best banking app in the world.